Whomever Wins the Presidency, Pressing Issues are Likely to Impact Performance of US Capital Market Indices

Regardless of which candidate wins the 2020 election, the incoming president will be confronted with a litany of pressing pandemic-related, economic, social, and geopolitical challenges. Each of the challenges is likely to have some impact on the future performance of major U.S. capital market indices.

When it Comes to the Stock Market, Giving Credit Where Credit is Due is Not Easy

While the economy is always a focal point in the election cycle, demographic and economic trends tend to drive markets over the long run. Additionally, this cycle will heavily weigh the health crisis and struggle for racial equality that has currently enmeshed the country. This being said, the domestic economy has grown markedly over the past forty years, creating a positive wealth effect for some citizens due to positive stock market returns, which has occurred throughout the terms of presidents from both major political parties. During this period, presidents have worked to implement their policies through congressional delegations that were friend, foe and split, so crediting one party or another for the economy or market performance for any one or small group of years, is not that simple. However, there remains an ongoing debate as to which party was responsible for creating the conditions which led to each period of prosperity or crisis. To better visualize how the market performed over time, during both Democratic and Republican administrations, consider the chart below:

|

| Click to enlarge graph. |

For the past 40 years, markets have generally been trending up. The only times there have been disruptions in the trend are the tech bubble of the early 2000s and the Global Financial Crisis of 2008-2009. Going back further, since World War II, when assessing the relationship between market performance and which party holds the White House, there has been only a minimal difference in stock returns when looking at a one year lagged return. The one year lagged return for the S&P 500 during a Democratic administration shows a 12.8% return, whereas during Republican presidencies it has been 12.3%.[1] However, reading too deeply into this small discrepancy returns might be a fool’s errand. Again, this is because the question remains as to which party is responsible for creating economic conditions that lead to a return (positive or negative) in any one or group of years.

Do Election Years Carry a Substantial Amount of Risk?

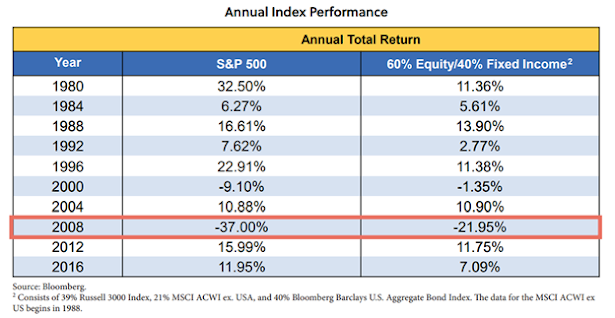

It is also worth mentioning that one of the biggest myths is that election years carry more risk than other years. To address this and dig deeper into the numbers, we created the table below, which highlights election years and the corresponding equity and sample portfolio returns.

|

| Click to enlarge chart. |

What we can see from the charts and tables above is that election years do not seem any more extreme (with perhaps the exception of 2008), nor do they seem to carry more risk than post-election years. At PFM, our approach is to continue to focus on the big picture – economic fundamentals and long-term strategic asset allocation – which we believe are the most important decisions driving investor’s portfolio performance.

There have been numerous articles about the VIX being elevated, but perspective is key. Currently, the stock market is coming down from elevated levels that stem from the impact of the coronavirus on companies, not who is in the White House. So, with all of the banter currently in the air, the details of the picture matter immensely. To further examine the legitimacy of this claim we went back to 1990 and created the chart and table below based on the beginning of month closing prices for the index.

|

| Click to enlarge graph. |

|

| Click to enlarge chart. |

While the chart might not show enough information to make a definitive statement, we extracted some additional data to focus more on the period around the election time period. As stated before, outside of the tech bubble time period and the Global Financial Crisis there has not been significant movements within the VIX outside of that.

Causation Does Not Equate to Correlation

In our opinion, the results of our findings is that over a 40-year period, the only time the S&P 500 experienced a truly extreme return in an election year was in 2002 and 2008, which coincide with the Tech Bubble and the height of the Global Financial Crisis (GFC). In short, based upon the above examples and data, we can confidently state:

- It is incredibly difficult to assign credit to any one political party for economic conditions, particularly since some fiscal policy and legislative (e.g., tax increases or cuts) decisions may take several years to fully impact GDP, or other economic measures of our nation’s health.

- Election volatility creates more noise for the markets than anything else

Sources

[1] Clearnomics,

Standard & Poor’s 2019.

PFM Asset Management is an Associate Member member of TEXPERS. The views expressed in this article are those of the authors and not necessarily Milliman nor TEXPERS.

About the Author

Floyd Simpson III, CFA, CFP, , is Senior Managing Consultant with PFM Asset Management LLC. As part of PFM’s OCIO business, Simpson works with clients across the country to develop and implement multi-asset class strategies for their portfolios. He also serves on the Multi-Asset Strategies Group and the Multi-Asset Class Investment Committee.

No comments:

Post a Comment