To Issue or Not to Issue, is That a Question?

Over the longer term, (i.e., 20 or 30 years), stocks have almost always outperformed bonds, meaning sought-for arbitrage has a high probability of materializing. However, a benefit plan sponsor should understand that, especially in the near term, issuing a benefit bond could result in a negative outcome from a budgetary perspective.

While any issuance’s success is not guaranteed, when an issuer determines that a POB or OPEB-OB merits exploration, consider these steps to help To make the view from the “benefit bonds window” more constructive:

- Issue when the benefits bond window is open (i.e., when market interest rates for issuing the bond are relatively low and assets in the pension fund are not peaking)

- Structure debt based on liability structure

- Size the issuance to help mitigate overfunding

- Invest proceeds exclusively in equities (where sought-after arbitrage exists) could possibly maximize returns

- Undertake structural changes necessary for an affordable, sustainable and sufficient benefit plan

Issuers

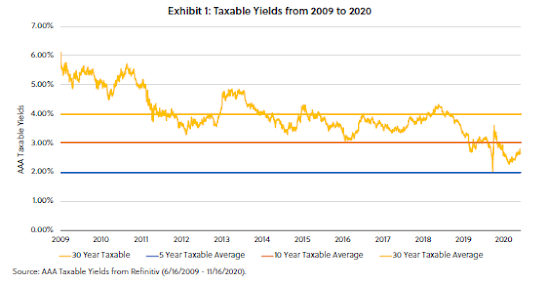

Historically, with only a 1.5% or 2% spread between issuance cost and long-term earnings expectations, risks, especially in the intermediate-term, were meaningful. Today, rates substantially lower than historic levels have dramatically reduced the risks related to earning less than the issuance cost or discount rate. Embedded costs related to the issuance are also substantially lower. With the rate margin between issuance cost and expected reinvestment returns having nearly doubled, this creates a substantial financial cushion to withstand downturn.

|

| Click chart to enlarge. |

When an issuer can borrow for 30 years at rates below the historical average rate on 10-year issues, a remarkable opportunity exists. But what are the prospects for investment-grade municipal issuers who do not carry a AAA credit rating to issue benefit bonds?

Exhibit 2 depicts the spread for AA, A, and BAA credits versus the AAA credit rating discussed above. Based on a current spread of 115 basis points (bps), a BAA credit could borrow at around 3.79%, lower than the 3.98% AAA average since 2009. For AA and A credits, a borrowing is even more attractive with 13 and 47 bps spreads to AAA credits, respectively. By any measurement, taxable municipal bond rates are attractive.

|

| Click chart to enlarge. |

The elimination of advanced refunding transactions also makes a taxable issuance more palatable today. Today, the market often turns to the taxable municipal bond market to achieve savings in the low-rate environment. As a result, market participants are more comfortable issuing taxable bonds. Further, borrowing at historical lows when not associated with enormous financial stress and equity market turmoil is unique.

Investors

Using PFM Asset Management's 2021 Capital Market Assumptions (CMAs), we can derive an expectation of outcomes for the reinvestment of benefit bond proceeds. We have traditionally made the case that an issuer should not sell municipal bonds to buy bonds in their portfolio since no material arbitrage exists. For purposes of comparison, we have modeled both a 100% equity portfolio (Equity) and a relatively plain vanilla 60% equity and 40% fixed income portfolio (60:40).

Since the goal when reinvesting benefit bonds is arbitrage, the logical strategy is to allocate primarily or exclusively to equities. That said, migrating the portfolio to a more typical allocation over time, either through asset allocation adjustments in a Section 115 pension trust or through contributions to a primary pension portfolio, makes sense.

Beginning with an intermediate-term view of the next five years, Exhibit 3 illustrates various expectations. The Equity portfolio has an expected return of 6.3%, with a substantial probability of eclipsing a 4% cost of issuance.

Based on this analysis, the likelihood of achieving an arbitrage seems exceptionally high. But what is the probability that the issuance creates both arbitrage and exceeds the discount rate? Utilizing a typical 7.25% discount rate for public plans1, the probability that the reinvestment proceeds exceed that annualized return is 59% for the Equity portfolio and 38% for the 60:40 portfolio. For plans with lower discount rates of about 6%, the probabilities are significantly higher.

|

| Click chart to enlarge. |

The Equity portfolio is expected to exceed the 6% rate 75% of the time, and the 60:40 portfolio is expected to exceed the 6% rate almost 66% of the time.

While we focused on probability in the context of the opportunity, the potential for a market downturn still exists. The floating bar chart below shows a wide array of potential outcomes, derived from the Monte Carlo simulation. It should be noted that, over a five-year period, roughly 25% of occurrences achieve no better than a 0.94 % annualized return for the 60:40 portfolio and a 1.43% annualized return for the Equity portfolio.

|

| Click chart to enlarge. |

Other Considerations

With low rates across the yield curve, plan sponsors may want to consider other elements of a typical benefit bond issuance to reduce overall risk, including:

- Considering the term and debt service structure of the benefit bonds. With rates quite low, some plan sponsors may shorten the term of the benefit bonds, effectively minimizing the unfunded liability’s amortization.

- Lowering the discount rate and/or modifying other actuarial assumptions in tandem with the benefit bond issuance can help reduce the future risk of actuarial losses. Contemplate a discount rate reduction in the context of long-term returns and the plan's expected asset allocation. The governing body should select a discount rate it believes is achievable over a long-term period and not in reaction to a specific short-term market action. Reducing the discount rate will necessarily increase the issuer's relative budget funding, so a long-term plan with stress testing may be prudent.

- While issuing in today's rate environment improves the probability of success, it does not assure success. Individual client circumstances differ, which could make the benefits bond issuance option better or worse.

About the Author: Jim Link, CEBS, is Managing Director at PFM Asset Management LLC. He is a leader in PFM’s outsourced chief investment officer (OCIO) team and Center for Retirement Finance, working collaboratively with colleagues across the firm to help clients solve complex retirement finance and asset management challenges and to deal with long-term liabilities. Link leads PFM’s Multi-Asset Strategies Group.

PFM Asset Management is an Associate member of TEXPERS. The views expressed in this article are those of the author and not necessarily PFM nor TEXPERS.

Follow TEXPERS on Facebook and Twitter and visit its website for the latest news about the public pension industry in Texas.

No comments:

Post a Comment