The Business of the Bonds Between People and Pets

Recent evidence suggests that there has been a broad and sustainable increase in pet ownership, due to changing attitudes toward pets, referred to as “humanization." People increasingly allow pets to sleep in bed with them, buy presents for them on special occasions and take other steps to personify their animal companions. Based on a survey by GfK, 57% of consumers in 22 countries owned a pet. Specifically, in the U.S., an estimated 67%, or approximately 85 million homes, owned a pet. Dogs are the most prevalent species of pets with over 60 million households owning a dog, followed by cats at just over 43 million households. This change in societal attitudes toward domesticated animals began some time ago and has grown as younger generations are having fewer children and later in life. This trend has also accelerated globally in recent months as pandemic-related stay-at-home orders have increased the desire for companionship as social interactions had been put on pause for much of 2020. Overall, pets are largely treated as members of the family, which generally reflects a greater sensitivity to and recognition of domesticated animals’ complexity and needs.

More Pets

The American Pet Products Association (APPA) National Pet Owners survey states that roughly 67% of U.S. households, approximately 85 million homes, own a pet. Pet ownership rates rose from 56% from when the survey was first taken in 1988. This implies an average annual gain of four-tenths of one percent, which equates to roughly 500,000 new pet-owning households each year.

|

| Click chart to enlarge. |

More Pampering

A recent report published by RestoraPet found that 90% of their respondents consider their pets to be a member of their family. The humanization of pets is further demonstrated by over half of the survey respondents who said they would spend “whatever it takes” to keep their pet happy and healthy. In addition, the bonds between humans and their pets were reinforced as a result of the COVID-19 pandemic. Pet owners largely agreed that their pets have given them great emotional comfort and support during these unprecedented times. Additionally, as many pet owners transitioned to working from home in 2020, owners have become more aware of the needs of their pet which may be a favorable trend in the industry over the next few quarters.

Increases in Pet Spending

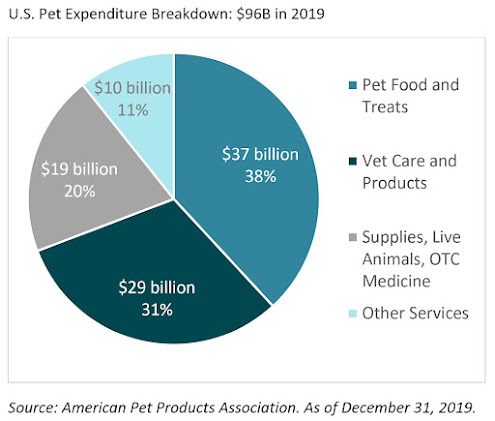

The rise in pet ownership and the closer bonds have led to increased amounts of spending on pets and pet-related services. In 2019, the APPA survey reported that $95.7 billion was spent on pets which has grown from $17 billion in 1994, representing 7.2% compound annual growth over the 25-year period. Some of the basic annual costs of owning a dog or cat total $1,466 and $908 respectively.

Further validating our belief that pet spending growth will be robust and sustainable is the fact that better medical treatment is resulting in longer life expectancies for pets. In addition, the Insurance Information Institute states that pet insurance, which started over a century ago in Sweden and was first sold in the United States in 1982, experienced significant growth in 2018, with a 17% increase in gross written premiums over 2017.

|

| Click chart to enlarge. |

Investing in Pet Spending

Based on our positive secular outlook for pet spending, we seek to find companies that we believe are poised to benefit from this spending trend and that offer specialized products with high barriers to entry. We currently own IDEXX Laboratories, Inc. (IDEXX), the leader in diagnostic tests and information systems for veterinary practices.

Offering its products and services globally, IDEXX provides diagnostic, detection and information systems for veterinary, food and water-testing applications. Veterinarians use the company’s VetTest analyzers for blood and urine chemistry and its SNAP in-office test kits to detect heartworms, feline leukemia and other diseases. The company provides lab-testing services and practice management software as well as operating an international network of veterinary reference laboratories. In addition, IDEXX makes diagnostic products to detect livestock and poultry diseases and to test for contaminants in water and milk. IDEXX’s Livestock and Poultry Diagnostics business includes products to test for Bovine Spongiform Encephalopathy (BSE or “mad cow” disease) as well as porcine illnesses and poultry diseases. IDEXX’s water-testing segment produces tests to detect E. coli, Enterococci and Cryptosporidium. The company’s dairy testing unit produces a SNAP test to measure antibiotic residues in milk, which are highly regulated in markets outside of the United States.

|

| Click chart to enlarge. |

The vet and related services category in which IDEXX participates has grown at 12% compound annual growth rate from 2015 to 2019. IDEXX expects 9% to 13% growth in their domestic Companion Animal Group (CAG) and 12% to 16% growth in international CAG. Most of CAG’s revenue comes from diagnostic products and services, including chemistry analyzers, rapid test kits and laboratory services. Diagnostic revenues, while growing, still account for only 15% of veterinary practice revenue. IDEXX has several new diagnostic tests, the most important being Symmetric Dimethylarginine (SDMA) for kidney disease, which we believe will result in increasing share gains in the veterinary market. As more impactful tests and easier testing methodologies are introduced, we see the potential for greater adoption of diagnostic testing in vet practices.

IDEXX’s long term financial model calls for greater than 10% annual revenue growth, 50-100 bps of margin expansion, 1-2% incremental EPS growth from capital allocation, which equates to 15-20% of annual EPS growth for the company. We believe the considerable opportunity for global adoption of animal diagnostic testing offers another tailwind for growth. IDEXX’s strong moat of innovation and market leadership should allow them to continue to gain market share and grow at above what we believe are attractive market growth rates.

About the Author: Thomas Hynes, Jr. is a Portfolio Manager and a Senior Research Analyst at Aristotle Atlantic. Prior to joining Aristotle Atlantic, he worked as a Portfolio Manager and Senior Analyst for Deutsche Asset Management. Hynes also has experience as a Director and Client Portfolio Manager at Citi and as a Director for Deutsche Bank Private Wealth Management. He earned his Bachelor of Science in Finance and Economics from Fordham University. Hynes is a CFA charterholder.

The opinions expressed herein are those of Aristotle Atlantic and are subject to change without notice. Aristotle Atlantic Partners strategies. Please click here for important additional disclosures. AAP-2102-5. Aristotle Atlantic Partners is an Associate member of TEXPERS. The views expressed in this article are those of the author and not necessarily Aristotle nor TEXPERS.

Follow TEXPERS on Facebook and Twitter and visit its website for the latest news about the public pension industry in Texas.

No comments:

Post a Comment