How the Global Industry Reset Will Create a Generational Investment Opportunity for Investors

I have been investing in the commercial aviation industry for nearly 20 years. My career started in March of 2001, so my early investing experience occurred during the period of aviation industry dislocation triggered by 9/11, which, while significant, pales in comparison to the impact Covid-19 is having on the travel industry. The pandemic has had an acute impact on the major incumbent capital providers in the aviation sector, leading to significant capital moving to the sidelines at a time when the industry desperately needs $150-$200 billion of capital.

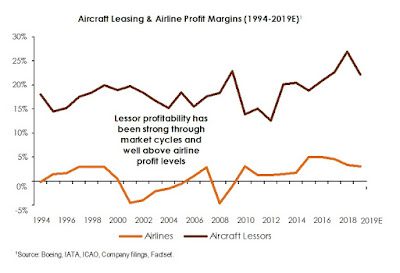

Historically, most investors have had a knee-jerk reaction when they first hear about investing in “aviation.” This is for good reason, as the historical record for profitability amongst airlines has been volatile with ample stories of airline restructurings and bankruptcies over the past few decades.

However, aviation investing is not limited to investing in airlines -- there is another story beneath the surface that we view as much more compelling, which is investing in the assets themselves (planes, etc.). In fact, one of the central reasons that the aviation industry has attracted capital over time has been the lack of correlation between airline profitability, on the one hand, and the profitability of those that finance or own the actual assets, on the other hand.

|

| Click chart to enlarge. |

Commercial aircraft are in some ways akin to flying real estate. While airlines fail and disappear, the assets themselves generally do not – which is why the aviation industry has exhibited resiliency through previous market shocks, and why we believe this industry will eventually recover and end up stronger on the other side.

|

| Click chart to enlarge. |

At its core, the fundamental health barometer for the commercial aviation industry is supply and demand. When this barometer is in equilibrium, the industry is healthy as the demand for travel is equally met by the supply of aircraft seats available. Throughout previous market shocks -- whether it be oil crises, geopolitical events, SARS, 9/11, the Global Financial Crisis, etc. -- the demand for air travel has always reverted to the mean relatively quickly.

|

| Click chart to enlarge. |

This time around, we believe this reversion is likely to take more time, perhaps 3-4 years, but we remain convinced of one thing: the air travel industry is not going away. In fact, there are

similarities to the Global Financial Crisis and how certain banks were considered of systemic

importance, and this is playing out within the airline industry as we speak, with certain countries stepping up and providing stimulus packages to benefit certain airlines.

Make no mistake about it, a number of airlines will need to restructure, and a number will inevitably fail. However, in what might seem like perverse calculus, this is a good thing.

Having observed the evolution of the US airline industry for some time, we see in the current moment evidence of an industry reset not dissimilar to those past. The pre-1978 regulated U.S. airline industry experienced profitability due to a lack of competition. When de-regulation hit it in 1978, we saw an industry in tumult, with airlines in and out of both restructurings and bankruptcies. Interestingly, this persisted up until 9/11 and through the Global Financial Crisis, until the US airline industry consolidated around four major airlines. Following that transition, those US airlines operated more profitably than they ever had in history. In contrast, when one observes the more fragmented European market and different markets throughout Asia, the reality is more like the US airline industry post-1978, where most airlines are struggling to survive in a hyper-competitive environment.

|

| Click chart to enlarge. |

Covid-19 should serve to reset the airline industry in a way where the surviving airlines come through stronger and with less competition. We believe that as the vaccine is distributed and confidence returns, air travel will pick up. We do not expect this to happen quickly, but rather methodically over the next three years. It’s important to keep in mind that the supply side of this industry is dominated by a duopoly between Airbus and Boeing, and the supply side of the equation will eventually adjust to what the appropriate level of new of aircraft is relative to the reality of demand during and after the pandemic. We have already seen signs of this with older aircraft being retired and new aircraft orders being cancelled or deferred.

The airlines that restructure or file for bankruptcy are each like dominoes and, as each domino falls over, it sends a shock wave out into the industry that hits incumbent capital providers that had existing exposure to aviation assets – including both leasing companies and traditional banks. Some of those in harm’s way include “tourist capital” (e.g., investors without experience investing through cycles in the aviation industry) that entered the space, which are invested in airline credits or asset types that are now under pressure.

As there is a disequilibrium between the demand for travel and current supply of aircraft, there is a similar imbalance between the need for liquidity in the space relative to what is available. Much of the liquidity historically came from a fragmented leasing ecosystem and a rigid traditional bank network. Prior to the pandemic, we had a thesis that traditional banks’ balance sheets would become more and more difficult to invest in aviation deals, chiefly due to Basel IV and regulatory capital considerations. Since the pandemic manifested, we have seen this thesis amplify, with an acute need for specialized, non-bank lenders to enter the space and fill the void left by incumbent capital that has moved out of the space.

We believe 2021 will offer a broad range of opportunities, including primary issuance of both senior and mezzanine loans. We also believe there will be a lot of activity relating to airlines looking for liquidity either through the capital markets, private debt markets or aircraft operating lease structures. We also believe it is inevitable that there will be a fair number of restructurings amongst airlines and leasing companies, and potentially banks looking to divest aviation investments. The overall dynamic is exciting to us. We believe there is a strong thesis for how the industry ultimately will recover and perhaps even be stronger on the other side of this pandemic. We also believe that the resulting aviation asset opportunity set over the next several years will be truly significant in scope, across both debt and equity financings.

About the Author: John Morabito is Managing Director of EnTrust Global and serves as the Portfolio Manager of the firm’s Blue Sky Aviation Fund. Most recently, Mr. Morabito was Head of the Financial Institutions Group for CIT Group’s Transportation Finance division with a focus on the Commercial Aviation segment and managing a global team of 15 investment professionals. Mr. Morabito spent 16 years with CIT Group, starting as a financial analyst and culminating with the successful sale of the aviation division to HNA Group in April 2017. Mr. Morabito brings nearly 20 years of experience in all aspects of commercial aircraft investments, having had management responsibilities for over $11 billion in assets. In addition, Mr. Morabito built an aviation direct lending business within CIT Bank following the financial crisis and also pioneered a joint venture with Tokyo Century Corporation in 2014, where he was responsible for managing $2 billion focused on aviation investments. Mr. Morabito maintains a deep network of proprietary relationships around the world that are critical to maintaining an attractive and specialized pipeline of opportunities. He received his bachelor’s degree with a concentration in finance from the University of North Carolina at Chapel Hill.

EnTrust is an Associate member of TEXPERS. PAST PERFORMANCE IS NOT AN INDICATION OF FUTURE RESULTS. This article is for informational purposes only. There is no guarantee that any investment opportunities discussed herein will be successful, or that investment losses will not occur. This is not an offering or recommendations of any of the securities or other investments discussed herein. Experience discussed in this document includes experience at prior firms. Information contained herein reflects subjective viewpoints regarding the financial markets and aviation industry trends and predictions relating to both. Such viewpoints may be incorrect.

Follow TEXPERS on Facebook and Twitter and visit its website for the latest news about the public pension industry in Texas.

No comments:

Post a Comment