Thursday, April 1, 2021

Wednesday, March 17, 2021

Webinar Focuses on Convertible Securities

Webcast Allows Retirement Fund Trustees and Administrators Opportunity to Earn Continuing Education Credit

Thursday, March 11, 2021

Thursday, March 4, 2021

Wednesday, January 27, 2021

Tuesday, January 12, 2021

Tuesday, November 3, 2020

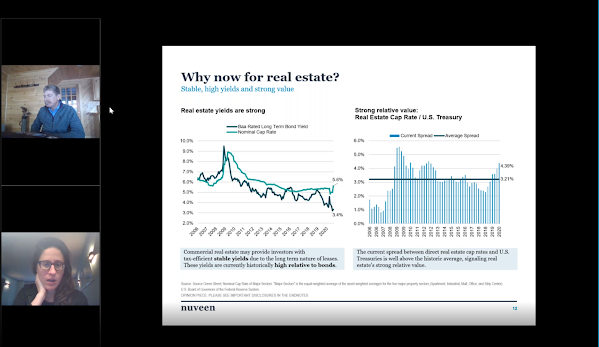

Catch Replay of Real Estate Investment Webinar

Pension Fund Trustees and Administrators Earn Continuing Education Credit Through TEXPERS' Online Learning

Friday, October 2, 2020

Committee Suggests Changes to 2019 Reporting Law

Recommendations Aim to Strengthen Law Requiring Independent Evaluations of Pension System Investments

Tuesday, September 15, 2020

TEXPERS Hosts Educational Webinar

Pension Industry Thought Leaders Discuss Outsourced CIO Relationships During Online Moderated Event

|

| Image by Alexandra_Koch from Pixabay |

What are the general duties of pension plan consultants and outsourced chief investment officers? TEXPERS gathered industry thought leaders for an educational webinar to give the trustees and administrators of TEXPERS' Member Systems advice on what pension plans should do to take stock of their funds' advisory relationships.

During the webinar, held Sept. 15, a moderator used a question-and-answer format allowing the panelists to identify some of the differences between non-discretionary and discretionary advisory models.

Click here to view a recording of the webinar. Those wanting to watch the video will be required to register for access.

During the session, the panel:

- Outlined some decision point considerations for plan trustees.

- Illustrated some of the more nuanced differences between the services.

- Revealed what the economic and market upheaval brought by the novel coronavirus pandemic has taught.

- Took audience questions relating to advisory relationships and the markets in general.

Future Webinars

TEXPERS is hosting educational webinars to help in the professional development of its Member Systems' trustees and administrators. Additional webinars are being planned.

The next webinar, Direct Lending – The Benefits of Scale and Differentiated Sourcing, will be held at 10 a.m. CDT on Wednesday, Sept. 23, 2020.

Synopsis: Since the Global Financial Crisis, investors globally continue in their search for yield, shifting capital from public to private markets, with private debt emerging as an attractive asset class for institutional investors seeking an illiquidity yield premium.

With the private debt market currently estimated to be ~$850 billion and likely to grow, in this webinar, Michael Patterson, Governing Partner and Portfolio Manager of Direct Lending Strategies at HPS Partners, will share insights on how best to extract attractive risk-adjusted returns through differentiated sourcing capabilities.Topics will include:

- Non-sponsor lending: not just sourcing, it’s about execution.

- Utilizing scale as a competitive advantage.

- Opportunities to find excess returns persist at the larger end of the lending market.

Earn Continuing Education Credits

New and Continuing pension system trustees and administrators who attended live webinars can earn one credit hour to satisfy state-mandated Continuing Education. To earn the credit, attendees are required to sit through the entire presentation, participate in polling questions during the session, and answer a survey emailed to attendees after the webinar. Those who do not sit through the webinar are unable to earn credit.

For additional information, email texpers@texpers.org or visit our website. Also, be sure to follow TEXPERS on Facebook and Twitter.

Monday, August 31, 2020

TEXPERS Launches Redesigned Website

Members Can Now Track

Continuing Education Credits Earned Online

The Texas Association of Public Employee Retirement Systems (TEXPERS) recently launched its redesigned website. The website, www.texpers.org, offers a user-friendly browsing experience for the association’s members, prospective members, and business partners.

“The new design offers streamlined menus, clear navigation, and a responsive layout for multiple platforms such as desktops, tablets, and mobile phones,” said Art Alfaro, TEXPER’s executive director. “The association staff are excited to have this project completed.”

Features and benefits of the newly designed site include:

- A more connected membership with social networking support

- Simple tools for membership to stay in touch

- Space for members to share resources and information

- Ability for members to keep records of their Continuing Education credit hours online

- Serving as primary source to collect membership dues and support event registrations

TEXPERS members who want to track their Continuing Education training credit hours will need to log into the site. Once logged in, visitors will see a "welcome" notice on the page along with the user's name. Once the visitor has accessed their member site, users can click on the "Your CE Credits" tab in the Quick Links panel on the right of the site page.

Once logged in, TEXPERS members may also update their profile or organization information, access a directory of members, and find links to the association's bylaws. The the site provides a news feed of the association's blog as well as live updates of TEXPERS' Twitter feed. Also, members should frequent the site to stay up to date on the association's latest events.

Now Live

The newly designed TEXPERS website is now live at www.texpers.org. The site is hosted through MemberClicks, which provides software solutions to help member-based organizations such as TEXPERS with membership management, event registration, and database needs.

The Texas Association of Public Employee Retirement Systems is a statewide, voluntary nonprofit educational association organized in 1989. Operated out of Austin, Texas, its members are trustees, administrators, professional service providers, employee groups and associations engaged or interested in the management of public employee retirement systems. TEXPERS member systems and employee group members represent 2.3 million active and retired public employees with assets totaling nearly $89 billion.