Thursday, April 15, 2021

Thursday, October 29, 2020

Investment Indices: The Inside Story

Both the Dow Jones Industrial Average and the S&P 500 Index Have Recently Made Changes. What Does That Mean for Retirement Investors?

Wednesday, August 19, 2020

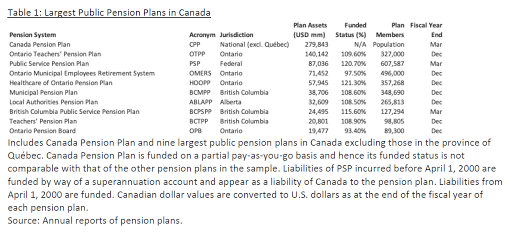

Researchers say U.S. pension systems can learn a lot from America's Northern neighbor

|

| Photo by Daniel Joseph Petty from Pexels. |

> READ MORE: The paper's authors wrote an article for Institutional Investor.

> LEARN MORE: Find out what NASRA has to say about pension reform.

- Plan funding was partially on a pay-as-you-go basis or through superannuation accounts

- Enhancement to benefit levels were retroactive and not matched with higher contribution rates

- Contributions were commingled with general government funds rather than funded into segregated accounts

- Active portfolio management was nonexistent

- Plans were defined in law that determined contribution rates by political processes and required legislative action to modify

- Because plans were sponsored by the government, beneficiaries were unable to influence plan design and lacked responsibility for ensuring plan solvency.

- Recognize the need for change. Outside factors, such as the current economic environment, are a catalyst for change.

- Solution needs to be at the appropriate level of government. Change should occur at least at the state level.

- Change requires strong leadership and effective civil service. Strong leaders must operate in each state, require the support of skilled professionals, and enable forums for sharing knowledge between jurisdictions.

- Adopt a consultative stakeholder approach to develop and implement reforms. Involve all parties in the reform process, including taxpayers, bondholders, and recipients of government services – not just plan members and retirees.

- Focus on holistic models for pension design and funding. Restructure funding models to focus on solvency rather than have benefits, contributions, and investing determined distinctly; remove plan terms from collective bargaining.

- Share burden of funding contributions more equitably. Understand pension funding within the framework of total compensation and consider a more equitable share of funding from plan members.

- Mandate sponsor funding. Hold governments accountable for funding of contributions.

- Align benefits and responsibilities through joint sponsorship. Construct a plan where members can make decisions and accept a shared risk for solvency.

- Enhance governance. Enact high standards for trustees and trustee education.

- Unify legislation. Utilize any existing tools for creating unified pension legislation and reconsider the possibility of setting national standards.

- Ensure viable model for funding accumulated deficits. Amortize unfunded liabilities using combination of sponsor funding and plan member contributions.

- Align investment strategies to liabilities and cash flows. Once plans are better funded, match asset allocation to liability management.

- Internalize investment management, where appropriate. Evaluate ability to address governance and compensation constraints to facilitate direct investing approach.

- Evaluate consortium model to achieve scale, where appropriate. Consider establishing consolidated investment management for groups of pension plans to achieve scale and reduce expenses.

- Enhance advisor standards. Enhance expectations for service providers as internal resources and governance are improved.

Wednesday, August 5, 2020

New report sheds light on retirement security and financial decision making

|

| Photo: Karolina Grabowska from Pexels. |

TEXPERS STAFF REPORT

> REPORT: Access a copy of the research brief.

Key Findings

- The study found that about half of people who retired between 1992 and 2014 had income, savings, and/or non-housing assets to maintain the same spending level for five consecutive years after retiring.

- Bureau found that the ability to maintain the same spending level in the first five years in retirement was associated with large spending cuts in later years.

The Consumer Protection Bureau is a federal agency responsible for consumer protection in the financial sector.

Retirement and Disability Research Consortium hosts free online conference on Aug. 6

|

| Image by Goumbik from Pixabay. |

TEXPERS’ System Members still have time to register for a

free online conference tomorrow that focuses on retirement and disability

research. The sessions won’t earn TEXPERS members continuing education credits,

but they may provide insight into how people are working, aging, and dying in

the United States.

The 22nd Annual Meeting of the Retirement and

Disability Research Consortium is hosting a virtual event from 9 a.m. to 5 p.m.

EST on Thursday, Aug. 6. The video conference’s various session presenters and

panelists will discuss topics including Social Security benefits and

demographic trends, housing for the retired and disabled, economic impact on life

expectancy, health risks impacting employment and finances, state and local

labor markets, working conditions, and retirement finances.

The digital conference is free and open to the public.

> REGISTER: Sign up here.

> AGENDA: Access conference schedule.

> AUDIO PREVIEW: Hear an excerpt from the book.

The Retirement and Disability Research Consortium was established by the U.S. Social Security Administration in 2018. The consortium provides support to the Center for Retirement Research at Boston College, which is hosting the event. The National Press Club, Washington, DC, is producing the online event.

Monday, July 27, 2020

NIRS webinar focuses on idiosyncratic risks that drive returns

|

| Photo by bongkarn thanyakij from Pexels |

> REGISTER: Click here to sign up for the free webinar.

NIRS' synopsis of the webinar:

During the webinar,

you will hear how investors can stitch together multi-asset portfolios in an

efficient and coherent fashion. The session also will cover why a risk

factor-based approach works well for alternative asset classes; how to

capitalize on the yield and diversification benefits of alternatives; and how

institutional investors can leverage the factor-based approach for multi-asset

portfolio construction.

Speakers include:

Dan Doonan, Executive Director, National Institute on Retirement Security

Nathan Shetty, Head of Multi-Asset Portfolio Management, Nuveen

The National Institute on Retirement Security is a nonprofit retirement security research and education organization. To see what other webinars NIRS has to offer, see a list of scheduled sessions and replays of past webinars on the organization's website.

Friday, February 14, 2020

When it comes to retirement,

public employees are looking for security

It’s St. Valentine’s Day and the Texas Association of Public Employee Retirement Systems asked a few of the nonprofit’s board members to share their love of defined-benefit retirement plans.

- Cutting benefits could have severe workforce consequences. Seventy-three percent of respondents indicated they would be more likely to leave their jobs if their pensions were cut.

- Nearly 92 percent of all state and local employees believe that abolishing secure-retirement plans for public employees would weaken a government’s ability to attract and retain qualified workers. A majority also indicates that doing away with pensions would undermine public safety and the U.S. education system.

- Among Millennials, those who reached young adulthood in the early 21st century and are collectively known as “dissatisfied job hoppers,” 84 percent working in state and local government indicate they are satisfied with their current jobs. Nearly 74 percent claim that a pension benefit is a significant reason they decided to work in the public sector, and 85 percent said they plan to stick with their current employer until they are eligible for retirement or can no longer work.

"I love my pension because it represents the years I worked as a firefighter for the City of Big Spring, Texas. The City of Big Spring Fire Department first initiated the pension plan back in the late 1930s and early '40s. Through the many years of change, the trustees have made steady improvements to the plan with the help of city leaders. The retirement plan provides security for my family and me."

- Paul Brown, TEXPERS Board President

Big Spring Firemen's Relief & Retirement Fund

Wednesday, September 20, 2017

“We host presenters and speakers to inform our members of what they should be aware of before retiring,” says Gracie Flores, the fund’s administrator. “It’s important that our members are ready for retirement. It is a big transition to move from work to retirement. Our seminars provide them the tools and information they need to make the process as smooth as possible.”

“Our Path to Retirement role play is a very popular portion of the seminar,” Flores says. “We have a person taking on the role of a future retiree. I’m there acting as the plan’s administrator, and we have a fire department official. We show our members exactly what they must do to retire, who they must talk to and what the process is like.”

“To reduce our liability, I only get speakers who have a relationship with the retirement system,” she says. “For example, CCFRS’ attorney presents the estate planning information.”

“It’s a fantastic program,” Bates says. “I learn a lot each year.”

“Getting ready for retirement can be stressful,” Bates says. “There are so many things you have to be aware of. I think all plans should have some program to help retirees prepare for retirement. Gracie [Flores] has done a wonderful job with the seminar.”

“Ours, of course, is on a smaller scale due to our member size and resources,” she says.

The San Antonio fund’s program attracts 60 to 80 people each time, says Warren Schott, the system’s executive director.

“If we had more demand, we would hold them more often,” he says. “But currently, twice a year seems to be working fine.”

“Soon-to-be retirees – regardless whether they are from a small or large fund – need to begin thinking about the numerous issues they will face in retirement,” Schott says. “No one else prepares them for this, so it seems logical that the pension fund would provide it.”

Houston

The fund’s retirement program began about 20 years ago. The system’s executive director, John Lawson, says 500 to 600 people attend the program, which runs a full day. He says because people are often busy and don’t have time to read and research the retirement topics on their own, it is important that pension systems work to educate their members after retirement.

|

| Allen Jones |