Thursday, February 25, 2021

Monday, December 21, 2020

Wednesday, October 28, 2020

Wednesday, September 9, 2020

Janus Henderson Presents Educational Webinar

The Session is Part of a New Series of Online Learning Aimed at

Pension Fund Trustees and Admins

| Screen capture of Sept. 9, 2020, webinar hosted by TEXPERS and presented by Janus Henderson Investors. |

TEXPERS STAFF REPORT

The Texas Association of Public Employee Retirement Systems and hosted an online discussion on the often overlooked risk and return benefits of adding Real Estate Investment Trusts (REITs) to a broader real estate portfolio.

The educational webinar was present by Janus Henderson Investors on Wednesday, Sept. 9.

> ON DEMAND: Click to watch a recording.

Danny Greenberger, portfolio manager of Global Property Equities, and Guy Barnard, co-head and portfolio manager of Global Property Equities, at Janus Henderson lead the educational session.

Over the last decade, institutional investors have turned to a range of private investments – equity, debt and real estate – in search of higher returns, said Geenberger and Barnard. However, they added, that while private equities and debt have outperformed their listed counterparts for the past 20 years, the same cannot be said in real estate. According to their presentation, many public plans are significantly underweight Real Estate Investment Trusts (REITs) relative to the size of the asset class.

- The ability to access "non-core" property types – such as self-storage, cell towers, data centers, single tenant net lease and manufactured housing – with long-term cash flow growth opportunities;

- The ability to be more nimble when shorter-term market opportunities arise;

- Daily liquidity

Webinar | Taking Stock of Your Advisory Relationship: Outsource CIO, Consultants, and the Market

Presented by PFM LLC, PNC Capital Advisors, & CBIZ Inc.

10 a.m. CST on Tuesday, Sept. 15, 2020

Qualifies for 1 credit hour for Basic or Advanced Trustee Training in Investments.

Webinar | Direct Lending - The Benefits of Scale and Differentiated Sourcing

Presented by HPS Investment Partners

10 a.m. CST on Wednesday, Sept. 23, 2020

Qualifies for 1 credit hour for Basic or Advanced Trustee Training in Investments.

Mandated Training Hours

Texas law requires the Pension Review Board to establish a Minimum Educational Training Program for trustees and system administrators of state and local public retirement systems. The PRB's Minimum Educational Training requirements include core and non-core topic areas. New trustees and administrators must earn a minimum of 7 hours of training within their first year of service. Continuing trustees and administrators must receive a minimum of 4 hours of training every two years after their first year of service.

TEXPERS is offering credit training hours for core and non-core topics. New trustees and administrators needing additional first-year training may do so online through the PRB's website.

>ADDITIONAL TRAINING: Pension Review Board MET Info

In May, TEXPERS hosted Controlled Acceleration: Using Derivatives to Manage Pension Plan Risk, Return & Liquidity. Sponsored by TEXPERS Consultant Member River and Mercantile, the webinar is accessible through the association's blog.

>WEBINAR REPLAY: Controlled Acceleration

In July, TEXPERS hosted COVID-19: Impact on a Pension Plan's Liquidity. Also sponsored by TEXPERS Consultant Member River and Mercantile, a replay of the webinar is accessible through the association's blog.

>WEBINAR REPLAY: Impact of COVID-19 on Liquidity

Tuesday, September 8, 2020

PRB Investment Committee Meets Online Sept. 29

The Pension Review Board Investment Committee meeting will be

streamed online on its YouTube channel

|

| Image by Alexandra_Koch from Pixabay |

The Texas Pension Review Board will host its Investment Committee meeting by teleconference at 10 a.m. CST on Tuesday, Sept. 29, 2020.

Click here for the meeting agenda.

The committee meeting will be streamed online on the PRB’s YouTube channel. That link will be available on the PRB homepage, www.prb.texas.gov, before the session begins.

The PRB encourages anyone who wants to provide public comment to pre-register with the PRB’s Office Manager, Lindsay Seymour, by Sept. 29, 2020, at 8 a.m. CT. To pre-register, call 512-463-1736 or 800-213-9425. Or, send an email to prb@prb.texas.gov.

Tuesday, August 25, 2020

Steady Growth in Suburban Vintage Multifamily

|

| Image by Tumisu from Pixabay |

Staff Report from Rastegar Property Company

Key Points

- Multifamily is a historically stable investment class

- Asset class has high occupancy and affordable rents

- Demand is generated by young professionals and families leaving urban centers for affordability and quality living

- Public health concerns drive need for suburban garden-style apartments

- Direct benefit: abundant value-add opportunity

The Economics in Vintage Multifamily

We

start with the pragmatic. Vintage multifamily performs well financially in

several regards.

Principally,

this asset class is more affordable for tenants and provides quality living

opportunities in good neighborhoods. Most vintage properties fall within the

‘Class-B/C’ category. In short, these classifications represent existing builds

(often pre-2000) in middle-class communities that typically need some

renovation and operational optimization to maximize net operating income (NOI) and

consequent value (based on the income approach to valuation inherent to

income-generating properties).

Historically,

multifamily experiences very high occupancy rates – in the mid 90% range since 2000, and remaining over 94% for the better part of

the last decade. Despite the recession, Class-B multifamily only dropped to a

little over 92% occupancy in 2009 and has steadily recovered since.

In contrast, Class-A has experienced consistent declines in occupancy in the post-Great Recession period, reaching as low as 90%. Additionally, vintage multifamily rents consistently grow at a faster rate than inflation, with an average 30-year return of 12%.

Another

bonus for multifamily is the high percentage of on-time payments. Compared to August of last year, the percentage of

renters paying on time has only dropped by 1.9% during this year’s COVID-19

impact. This is due both to the resilience of workers and families, and the

relief provided by the CARES Act and local government initiatives.

Reduced

competition is

another advantage of vintage multifamily. Most new development in multifamily

is concentrated in Class-A, resulting in significantly less new inventory in

Class-B.

Additionally,

compared to new builds, Class-B/C assets can be acquired below replacement

value, are much less costly to renovate, and encounter fewer zoning approval

issues, delays, missed milestones, and cost-overruns.

Incidentally,

vintage assets don’t experience funding shortfalls as do chic Class-A

developments with higher beta. The low risk, substantial upside, and consistent

demand for middle-class rentals put both institutional and private investors at

ease.

User Trends Drive Performance

We

know that multifamily is a strong performer, but what is it about vintage multifamily

that appeals to tenants and keeps occupancy high?

Noted

previously, affordability is a primary driver. As rents continuously rise in

gateway cities, secondary and tertiary markets are becoming more popular – not

only for residential properties and users, but also for tech and other firms

looking for better amenities, lower leasing expenses, and availability and

quality of labor.

As

corporate enterprises move to secondary (more suburban) markets – such as Tesla to South Austin, they’re drawing skilled labor with them

that favors affordable long-term living accommodations.

Additionally,

the remote working trend is enabling families and professionals to shift away from urban centers in pursuit of superior air quality,

affordability, and a better environment to work and thrive.

Control Over Value in Vintage Multifamily

Perhaps

the most exceptional quality of vintage multifamily is the ability to control value through expense and income optimization.

Compared

to securities and other assets, income-generating residential property offers

excellent potential to improve conditions and enhance amenities, thereby

increasing marketability and rental rates.

Without

exception, we find that every multifamily property has opportunities to more

effectively manage expenses, and generate ancillary revenue streams, to boost

NOI and property value in the near term.

With

the multitude of viable acquisition prospects available in this asset class,

we’ve found it relatively straightforward to find, vet and build a portfolio of

the very best properties with low risk and tremendous income potential.

Visible in the Horizon

We’re in a dynamic economic and social environment. Accordingly, sourcing low-risk, robust investments with projected long-term stability is central to the goal of building portfolios that will weather recession or another national crisis. Vintage multifamily assets have proven to be among the most resilient classes of real estate over the last 20 years and should continue to flourish in the visible economic horizon.

Rastegar Property Company is an Associate Member of TEXPERS. The views expressed in this article are those of the authors and not necessarily RASTEGAR nor TEXPERS.

Factors First: A Risk-based Approach to Harnessing Alternative Sources of Income

|

| Image by Arek Socha from Pixabay |

The income-generating potential of alternatives seems to be largely underappreciated, despite the trend toward larger allocations to alternative asset classes in institutional portfolios and the quest for yield in a low-rate environment. When we ask institutional investors what roles they look for alternatives to play in a multi-asset portfolio, diversification is the top priority, followed closely by total return. Income generation usually is a distant third.

Institutional investors can enhance their ability to capitalize on the yield and diversification benefits of alternatives by focusing on the risks that drive returns in each specific segment of the alternatives universe. This approach allows investors to stitch together multi-asset portfolios in a more efficient, coherent way.

Executing this, however, is no simple task. If done incorrectly, investors risk negating some of the diversification benefits that make alternatives such valuable contributors to stronger, more resilient portfolios.

Know what risk factors drive return

Alternative asset classes such as private credit, real assets (farmland, timberland and private equity infrastructure investments) as well as non-traditional sectors of fixed income (preferred securities, emerging markets debt, high yield corporate debt and leveraged loans) present attractive income-generating potential.

Idiosyncratic risks play a vital role in driving returns in each of these asset classes — and these risks are what institutional investors should be trying to harness in an income-generating multi-asset portfolio. But it is important to note that each of these asset classes has significant exposure, in varying degrees, to the core, broad-based risk factors: equity, credit spread and rate duration.

As the chart below illustrates, idiosyncratic risks account for less than 60% of the contribution to total risk in all of the alternative asset classes included in the chart, except for real estate. With emerging markets debt, for example, equity risk accounts for 36% of the total risk and credit risk accounts for an additional 33%.

Preferreds are also an interesting case. Some investors consider them to be more like an equity instrument while others consider them to be more like fixed income. This debate is easily settled when viewed through a risk decomposition lens, which

shows that equity risk and idiosyncratic risk account for the totality of risk

for preferreds.

|

| Click chart to enlarge. |

This isn’t to imply that emerging markets debt and infrastructure aren’t valuable diversifiers. Rather, it is to highlight that unless an investor decomposes the risk contributors, a portfolio could end up with significantly more exposure to equity, credit or rate risk than the investor bargained for.

Allocate to risk factors, not asset classes

Investors are compensated for owning risk, not asset classes. We believe that their portfolio construction processes should reflect this and we have developed a five-step approach to do just that:

- Decompose risk factors driving the performance of asset classes

- Analyze how the market is compensating those risk factors

- Determine which risks need to be owned to fulfill investment objectives and constraints

- Determine which asset classes and vehicles will achieve the desired risk exposures

- Monitor risk and asset class relationships and how the market is compensating risks

The benefits of a risk-first approach

This framework puts risk at the heart of constructing multi-asset portfolios and delivers multiple benefits to investors. As already noted, it reduces the risk of overconcentration of risk factors in a portfolio, which could undermine the diversification benefits investors seek from alternatives.

It also encourages a more nimble approach to pursuing yield. The relationships among the risk factors and thus the relationships among the asset classes are constantly evolving — and the degree to which the market is compensating various risks is always changing. Predefined asset allocation constraints limit an investor’s ability to exploit these changes and manage risk.

The framework fosters a more nuanced approach to managing liquidity. Liquidity risk is just one of the idiosyncratic risks of an investment. But when using alternatives to generate income and cash flows needed to fund a set liability, liquidity becomes the idiosyncratic risk that institutions need to understand the best. Taking a risk-first approach to multi-asset portfolio construction frees an investor to take a more nuanced and sophisticated approach to managing liquidity risk — not just with alternatives, but across the entire portfolio.

Learn more about harnessing alternative sources of income

The full

paper with complete disclosures can be found at Nuveen.com.

Nuveen is an Associate Member of TEXPERS. The views expressed in this article are those of the authors and not necessarily Nuveen nor TEXPERS.

Sources

All market and economic data from Bloomberg, FactSet and Morningstar.

Monday, August 24, 2020

Has COVID-19 Made Sustainable Investing More – or Less – Important?

|

| Photo courtesy of Macquarie Group LTD. |

Environmental, social, and governance (ESG) investing has drawn considerable investor attention in recent years. Morningstar[1] reported that 2019 represented a record year of flows into ESG-related funds in both Europe and the United States. Along with this increased interest, Macquarie Investment Management has continued its commitment to sustainability such as through new ESG analytical and performance measurement tools for investment teams to integrate into their process. Yet, as the world continues to seek effective ways to deal with the COVID-19 pandemic, investors have questioned if there has been a shift in the relative importance of ESG issues when assessing investments. In other words, has ESG lost some of its relevance during the pandemic – or does the crisis make it even more important.

There are currently two schools of thoughts on this subject. One is that with the considerable toll that the pandemic has taken from both a societal and economic standpoint, seemingly more distant and lower priority issues such as climate change will take a back seat, especially as financial assets needed to make changes appear more scarce.

The other thought is that people have been ignoring warnings about a global pandemic for quite some time and the resulting lack of preparedness is a critical problem the world now faces. The same logic can be applied to longer-tail issues such as climate risk, where a potential crisis may similarly be lessened with nearer-term action.

An eye to the long term

Macquarie Investment Management’s view on the relative importance of ESG in the investment process has not changed as the result of the pandemic. As Lotte Beck, ESG manager for Macquarie’s Luxembourg-based ValueInvest team, put it, “Our approach to ESG has always been to look at it as a stamp of quality. Stable, quality companies usually also have a higher level of ESG management and vice versa.”

The majority of our investment teams employ a fundamental approach toward identifying and assessing securities. Inherent to their investment process is an in-depth analysis of economic, competitive, and other factors that may influence future revenues and earnings of the issuer of the securities, including factors that have been identified as material from an ESG perspective.

Parsing out “E,” “S,” and “G”

This emphasis on materiality may result in a shift in focus regarding ESG factor consideration when evaluating potential investments. In the past few years, the “E” in ESG – environmental – has taken on ever increasing importance as investors have assessed the risks of climate change and its potential effect on a company’s future revenue and expenses. An example of this is the impact of global warming on the future crop supply for food processors and other industries that rely on these vital raw materials. In a 2019 report, the US Department of Agriculture’s Economic Research Service found that if greenhouse gasses are allowed to continue to increase, US production of corn and soybeans could decline as much as 80% over the next 60 years.

Of a more immediate nature are the dramatic increase in wildfires in recent years that many attribute to climate change. Barry Klein, utilities analyst on Macquarie’s Global Listed Infrastructure team, has regularly traveled to California to gain insights into the impact of utility-caused wildfires, assess the response of utilities, and meet with legislators, regulators, and management teams. “It’s important, from both an investment and an environmental responsibility perspective, that we gain a full understanding of the response of the different parties, and how seriously they are taking this growing issue,” Klein said.While environmental factors remain important risks to consider, “S”, or social factors, are also taking on increasing importance as investors assess the risks of COVID-19 on individual companies. Workplace health and safety is a social factor that the Sustainability Accounting Standards Board (SASB) has identified as being important to many industries. Adrian David, senior credit analyst on Macquarie’s Fixed Income Global Credit Research team, pointed out that workplace safety has historically been a big focus for riskier industries such as mining or energy, Now, challenged by the rapid spread of the virus, more companies outside these sectors are considering how they can operate while providing a safe environment for their staff.

The “G”, or governance aspect of ESG, has always been an important area of focus for investors and will continue to be in the current environment. Steven Catricks, senior portfolio manager on Macquarie’s US Small Mid Cap Value Equity team, noted “how companies address governance issues such as executive compensation will be an important determinant of management quality. Share buyback and dividend policy will also take on greater relevance as stakeholders assess managements’ ability to be effective stewards of capital.”

ESG only a subset of fundamental analysis

[1] Morningstar, Jan. 10, 2020, “Sustainable Fund Flows in 2019 Smash Previous Records.”

[2] Morningstar, May 14, 2020, “There’s Ample Room for Sustainable Investing to Grow in the U.S.”

About the Author

Barry Gladstein, CFA, leads Macquarie Investment Management’s Environmental, Social, and Governance (ESG) efforts.

Defined Contribution Retirement Plan Fees: Lawsuits, Leveling and Lessons Learned

Pandemic Reshapes the Outlook for Farmland Investments

|

| Image by Pexels from Pixabay |

There may never be another global event akin to the COVID-19 pandemic in our lifetimes that more clearly tests the investment thesis for farmland as a component of a diversified institutional investment portfolio. Investors make strategic allocations to farmland for its diversification potential, low correlation to more traditional asset classes, and inflation-hedging properties. These benefits derive from the unique drivers of farmland: the need for food security, global population growth, and an emerging middle class with an increasing demand for animal protein, to name a few.

|

| Click chart to enlarge. |

The pandemic has highlighted critical vulnerabilities in our food supply infrastructure. Many U.S. consumers experienced significant disruptions getting their groceries as stores have struggled to keep shelves stocked under surging demand for essential items. Sales at grocery stores can be expected to stay at levels well in excess of historical norms for the foreseeable future, but demand from restaurants and other food service providers will likely continue to be significantly affected by closures or reduced operations, leading to disruptions in the associated supply chain. The loss of demand from food service providers leaves some agricultural producers in a difficult position. Because they cannot easily shift to distributing products into the retail supply chain as a result of labeling and packaging limitations, many farmers have been saddled with excess inventory.

Other dislocations have arisen at different rungs of the value chain as a result of the virus. Closures at meat processors, for instance, sent prices on products like ground beef surging on anticipation of a looming shortage. Additionally, the implementation of additional safety measures necessary to protect workers has, in some instances, reduced productivity.

It will take time to fully assess the impact of COVID-19 on the supply chain and the effectiveness of these protective measures.

|

| Click chart to enlarge. |

The opportunity for farmland investment remains attractive, particularly within strategies focusing on asset-level value enhancements. Low commodity prices and rising input costs have been headwinds for farmers in recent years, limiting their ability to scale up operations or make farm-level improvements, thus providing opportunities for value-add investors. The upheaval in food consumption patterns, the supply chain, and associated infrastructure may also generate additional opportunities for patient investors.

Over the near term, Callan does not anticipate COVID-19 will impact farmland valuations. Cash rents for farmland assets are generally paid in one or two installments over the course of the year, with the first usually coming due around March 1. Many farmers had already paid their rent for the year before concerns over the coronavirus fully materialized in mid- to late March. Valuations over the long term will depend on how a number of factors play out over the next several months; however, the asset class has historically held its value through periods of economic downturn or uncertainty.

As investors find a renewed interest in safe-haven investments in response to current market conditions, farmland is worth a closer look.

Callan is a Consultant Member of TEXPERS.The views expressed in this article are those of the author and not necessarily Callan nor TEXPERS.

About the Author:

Sally Haskins is a senior vice president and co-manager of Callan's Real Assets Consulting group. She has overall responsibility for real assets consulting services, and oversees research and implementation of real estate, timber, infrastructure, and agricultural asset classes. She also oversees all investment due diligence for real assets. She is responsible for strategic planning, implementation, and performance oversight of plan sponsor clients' real assets portfolios. Haskins is a member of Callan’s Alternatives Review and Management committees. She is also a member of the Pension Real Estate Association Board of Directors.Thursday, August 20, 2020

Sportswear: Sweet Success Amid COVID-19?

As a discretionary good, sportswear may seem an unlikely

winner in the wake of COVID-19. But the category—which includes athletic

apparel and footwear—has some unique characteristics that make us think it will

emerge just fine. In fact, for stronger companies, we believe COVID-19 will be

an accelerant as the companies leverage their connections with consumers and

drive business through more profitable channels.

A Long Runway for Growth

The total addressable market (TAM) in the sportswear space is estimated at $472 billion globally.

WHAT IT MEANS: Total addressable market is a term that is typically used to reference the revenue opportunity available for a product or service.

At William Blair Investment Management, while apparel and footwear is a low-growth category overall, we have seen sportswear take increasing share over time. Sportswear increased from about 18% of the apparel category in 2007 to almost 26% in 2019.

In fact, sportswear has shown a 6.5% compound annual

growth rate (CAGR) over the past five years, one-and-a-half times that of the

apparel market

We believe this trend will continue, driven in part by a

growing middle class around the world. Per capita sportswear spending in

emerging markets, particularly China, is one-tenth that of the United States,

and has plenty of room to grow.

Economic Cycles: Mostly Background Noise

The sector’s behavior in response to economic cycles has

been mixed. While there is an impact from the economic backdrop, there are many

times that results have been detached from the economic cycle.

For example, sportswear growth peaked in 1995 and

decelerated through 1999, leading the stocks to underperform the broader

market. After bottoming in 1999, sportswear started a five-year growth

acceleration, leading to strong stock performance.

This is exactly the opposite of what the broader market

was doing: The market peaked in 2000, and growth slowed as the U.S. economy

went into a recession in March 2001.

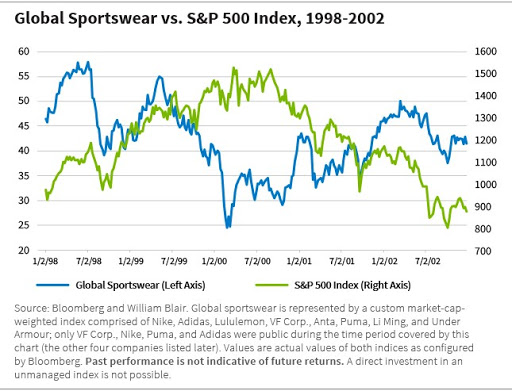

As the chart below shows, the S&P 500 Index peaked at

roughly the same time sportswear bottomed, presenting a prominent case for how

sportswear performance has detached from the economic backdrop at times.

WHAT IT MEANS: The S&P 500 is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the U.S.

This was also apparent after the 9/11 attacks,

where we saw sportswear quickly recover despite continued weakness in the

broader market.

|

| Click chart to enlarge. |

We saw more economic sensitivity

during the global financial crisis (GFC). Both the S&P 500 Index and

sportswear companies peaked around the same time, within two to three months of

each other.

|

| Click chart to enlarge. |

However, sportswear fundamentals

were fairly resilient. Revenues across the group declined 3% in 2009 and

earnings before interest and taxes (EBIT) were down 35%, but there was a strong

rebound in 2010. While sportswear fundamentals recovered within five to seven

quarters, sportswear stocks surpassed prior peaks within a year of

bottoming—much faster than the market, due to clear visibility and robust

growth.

The key takeaway: economic cycles

matter, but they have not been as impactful as we might think they would be. We

are seeing a number of sportswear companies perform outside of the economic

cycle.

Product Cycles: Critical in the Near and Medium Term

To understand the sportswear

space, one must appreciate product cycles. While sportswear companies are not

high-fashion companies, there is a fashion element to their success, and they

need to remain on trend.

WHAT IT MEANS: A product cycle is the length of time a product is introduced to consumers into the market until it's removed from the shelves

The chart below illustrates how

three key sportswear companies performed in past product cycles.

|

| Click chart to enlarge. |

A running-related product cycle

started in the mid-2000s. It was interrupted somewhat by the GFC, but then came

back with a vengeance. This is when we saw the Nike Free and Vibram Five

Fingers products take off.

Sportswear Company 1 in the chart

above was well positioned for this cycle; Sportswear Company 3 was not. As a

result, Sportswear Company 1 outperformed Sportswear Company 3 significantly

from 2012 to 2015.

Then, from 2015 to 2018, retro

sportswear came into fashion. Sportswear Company 1 continued to push the

running platform while Sportswear Company 3 was on trend for retro. Guess which

outperformed?

We are now in a new product cycle

that we call high fashion and collaborations. Brands are collaborating with

different designers and luxury houses (Kanye West, Selena Gomez, Beyoncé, Dior,

and Off-White to name just a few), and new product releases are coming out

monthly if not weekly. Most leading brands are participating successfully in

this trend.

There are two key takeaways.

First, the category has a degree of fashion risk (such as the move away from

technical performance and athletic functionality), although it is less

pronounced than in luxury or casual wear.

Second, once we identify companies

that we believe have strong brand equity and solid management teams, we need to

make sure we are patient, because even the best will potentially miss a trend

and have a period of underperformance relative to peers.

Investment Opportunities

Over time we have seen brands

rationalize their supply chains, allocating more orders to what we would call

key manufacturing partners. We view key suppliers as strategic partners and

more akin to internal manufacturing than external. A single supplier, for

example, manufactures about one-sixth of Nike’s shoes globally.

We also see this happening on the

distribution side. Brands are culling undifferentiated wholesalers and

diverting more in-demand products to strategic retail partners. We view these

retail partners as part of a brand’s direct-to-consumer efforts more than

wholesale.

The return on invested capital

(ROIC) for these strategic partners is typically fairly robust and at times has

exceeded the brands’ ROIC, indicating that there is substantial value creation

throughout the entire value chain.

WHAT IT MEANS: Return on invested capital is a calculation used to assess a company's efficiency at allocating the capital under its control to profitable investments. The return on invested capital ratio gives a sense of how well a company uses its money to generate profits.

On that note, we see a long runway

for brands to shift sales from the wholesale channel (70% of Nike’s and

Adidas’s business) to the direct-to-consumer (DTC) channel, which includes

their own retail footprints and e-commerce operations.

WHAT IT MEANS: Direct-to-consumer is the selling of products directly to customers, bypassing any third-party retailers, wholesalers, or any other middlemen.

We believe the big brands have the

potential to reach about 50% DTC penetration in the next 10 years, and perhaps

even higher over the long term. Some estimates place DTC at 70% of the sales

mix.

While brands do not provide the

profitability difference between the two channels, we estimate that DTC

generates double the revenue and EBIT dollars of wholesale, underscoring just

how accretive the mix shift from wholesale to DTC is.

WHAT IT MEANS: EBIT stands for earnings before interest and taxes, and is a company's net income before income tax expense and interest expenses are deducted.

Sportswear in the Wake of COVID-19

We have long identified health and wellness as a structural theme driven by consumers being increasingly concerned by the connection between their lifestyle (physical activity and food consumption) and their overall health.

COVID-19 and the potential health

risks have intensified the desire to eat better, live better, and feel better.

We believe sportswear is well positioned to benefit from this as consumers

express this desire through active lifestyles.

While we believe the long-term

view for sportswear remains positive, COVID-19 has presented an unprecedented

situation resulting in a coordinated global retail shutdown. The ensuing

consumer weakness (such as unemployment), combined with a broader apparel and

footwear inventory glut, will likely hurt discretionary spending overall.

This will undoubtedly depress

near-term sales and margins as sportswear companies adjust to overall market

conditions.

Despite these challenges,

sportswear appears to be a resilient category in the midst of COVID-19, and not

just because the pandemic appears to have intensified consumers’ desire to

focus on their health and wellness.

Sportswear companies, over the

past few years, have woven digital engagement into their DNA. Their ability to

speak directly to an audience without a physical footprint, amplify their

messaging, and drive engagement has allowed them to drastically accelerate

online sales during the lockdown.

Multiple brands, for example, have

reported triple-digit e-commerce growth in China throughout the lockdown,

helping them offset lost brick-and-mortar retail sales.

While the pace of the recovery

varies by brand and region, we are encouraged by what we are seeing and

anticipate that sportswear sales will be one of the fastest discretionary

categories to recover, as we have seen in prior downturns. As retail conditions

normalize globally, so will sportswear sales.

After all, the category has a long track record of value creation over the past 30 years. We have every reason to believe this will continue over the long term.

Thursday, July 30, 2020

Investment industry association to host virtual conversation with NCPER’s Hank Kim

TEXPERS investments industry members might want to check out an upcoming webinar providing insights on the impact of COVID-19 on investment strategies and allocations as well as how diverse managers fit into it.

Industry Insights: A Virtual Conversation is hosted by the National Association of Investment Companies as part of the group’s NAIC Insights Series. Hank Kim, executive director and counsel at the National Conference on Public Employee Retirement Systems will lead the live streaming event set for 1 p.m. CDT on Tuesday, Aug. 4.

As executive director of NCPERS, Kim oversees the operations of the largest public pension trade association in the U.S. During the live stream, Kim will discuss the association’s role in the public pension industry; its advocacy, research, and education initiatives; as well as provide insight for investors and general partners.

> REGISTRATION: RSVP for the online event

Monday, July 27, 2020

NIRS webinar focuses on idiosyncratic risks that drive returns

|

| Photo by bongkarn thanyakij from Pexels |

> REGISTER: Click here to sign up for the free webinar.

NIRS' synopsis of the webinar:

During the webinar,

you will hear how investors can stitch together multi-asset portfolios in an

efficient and coherent fashion. The session also will cover why a risk

factor-based approach works well for alternative asset classes; how to

capitalize on the yield and diversification benefits of alternatives; and how

institutional investors can leverage the factor-based approach for multi-asset

portfolio construction.

Speakers include:

Dan Doonan, Executive Director, National Institute on Retirement Security

Nathan Shetty, Head of Multi-Asset Portfolio Management, Nuveen

The National Institute on Retirement Security is a nonprofit retirement security research and education organization. To see what other webinars NIRS has to offer, see a list of scheduled sessions and replays of past webinars on the organization's website.