|

| Image by Samuel F. Johanns from Pixabay |

Key Points

- Institutional investors face a balancing act between two equally important needs: achieving robust long-term returns while avoiding the painful consequences of near-term drawdowns.

- Traditional asset allocation, risk parity and other hedging strategies have failed to perform as expected during recent downturns. Fixed income assets have moved closely in line with equities in times of crisis.

- Equity volatility levels exhibit a persistent and reliable relationship with equity returns over time and through market cycles, including the latest market crisis, as illustrated for large cap U.S. equities in Chart 1.

- A permanent strategic allocation to an equity stabilization strategy that utilizes the persistent volatility/return relationship can improve investors’ long-term risk/return ratios – even if implemented right after a market selloff. A rules-based approach, using the reliable indicator of recent volatility, can be successfully applied at any time via a spectrum of implementations against single or multiple risk asset class portfolios.

Chart 1: There is a Clear Relationship Between Monthly Equity Returns and Recent Volatility

Average Monthly S&P 500 Returns for Ranges of Realized Monthly Volatility(January 1, 1928 – March 31, 2020)

Risk Assets: Investors Manage a Double-Edged Sword

Institutional investors face the pernicious dilemma of having mutually conflicting needs. When building a portfolio, investors start with the understanding that, over the long term, expected return and volatility are strongly positively correlated. Unfortunately, most investors need both significant levels of return to meet their long-term goals and a stable stream of returns to ensure financial viability. A defined benefit pension plan, for example, needs solid returns to meet its actuarial funding goals and pay pensions, while it needs stability to avoid erosion of its funded status.

For institutional investors seeking stable funding, the same risk assets that provide essential upside potential also represent significant exposure to downside risk and unstable results. Although investors’ need for risk mitigation is high, most investors have not implemented such strategies to date, for reasons we discuss below.

The Risks of Managing Risk: Why Most Portfolios Remain Exposed

For a risk mitigation strategy to be reliable, it must be built on a market relationship that is persistent over time. Unfortunately, most risk mitigation strategies to-date have been based on historic correlations that have broken down during strong bear markets, when they are most needed.

Fixed Income is an Anchor to Windward Until a

Hurricane Comes

Unfortunately, the correlation between fixed income and equity investments is not stable through time. As Chart 2 illustrates, there have been long periods where equities and bonds were positively correlated, and thus traditional portfolio diversification did not reduce portfolio risk.

Chart 2: Fixed Income is Not a Reliable Equity Hedge

3-Month Rolling Correlation – S&P 500 and Bloomberg Barclays U.S. Aggregate Bond IndexIn crises — when an offset to downside equity risk is most needed — equities and fixed income often sell off at the same time. During the COVID-19 crisis, the correlation between fixed income assets and equities quickly became much less negative, diluting fixed income’s portfolio diversification benefit. Further, there have been extended periods of time where fixed income was positively correlated with equity. Both are highlighted in the circles in Chart 2.

Volatility is a Reliable Indicator of Equity Performance

A persistent and reliable relationship exists between 1-month volatility and 1‑month equity returns, both positive and negative. Volatility episodes tend to demonstrate persistence. As Chart 3 clearly shows, since 1928, for the S&P 500, high 1-month volatility tends to be associated with poor 1-month returns; and vice versa.

Chart 3: Since 1928, Volatility Levels Have Reliably Signaled Equity Returns

Average Monthly S&P 500 Return vs. Average Monthly Realized Volatility

Volatility-Based Equity Stabilization Strategy Can Improve the Risk/Return Ratio

A strategy based on the reliably strong relationship between equity volatility and returns is well-suited to deliver portfolio risk mitigation in a more consistent manner than traditional asset allocation. An Equity Stabilization Strategy systematically adjusts equity exposures based on the volatility/return relationship. This approach holds greater equity market exposure during lower volatility periods, which tends to lead to better performance, as illustrated in Chart 3. Conversely, we believe this approach can quickly reduce equity market exposure during the higher volatility periods that tend to produce unfavorable performance, mitigating the drawdown of assets.

The Case for a Permanent Strategic Portfolio Allocation to Volatility-Based Equity Stabilization Strategies

To-date, institutional investors have implemented volatility-based stabilization strategies sporadically or not at all. We believe this reticence is due to two key investor concerns: Portfolio risk hedging is complex, and a desire to avoid periodic carrying costs of hedging – particularly right after a major market selloff.

A permanent strategic allocation to a systematic volatility-based approach over a full market cycle addresses both of these issues.

Implementing Volatility-Based Risk Mitigation is Straightforward

The Stabilized Equity Portfolio Hypothetical Example, is based on a pension plan aiming to reduce its domestic U.S. equity annualized volatility by about 25% from its historic average level of around 18% per annum. In this hypothetical, the pension fund added a futures-based overlay on top of its equity portfolio, using listed S&P 500 futures to dial the effective equity exposure up or down based on volatility. Using this overlay, the portfolio manager allows the portfolio’s effective equity position to drop down to 20% of the portfolio’s net assets in high volatility environments and increase it to as much as 150% in low volatility environments.

Chart 4: Equity Stabilization Strategy Improves Risk/Return

Stabilized Equity Portfolio Hypothetical Risk & Return

Skillful Implementation Adds Further Value to a Stabilization Strategy

The pension fund’s overlay manager should take the following steps:

- Run the overlay model daily

- Combine experience-based judgement and additional subsidiary indicators such as the VIX and high-yield spreads to better assess the likely volatility environment daily

- Primarily use listed futures, and use listed options when inexpensive or more attractive

- Employ strict trading rules to protect the pension fund from being whipsawed in rapidly changing market environments

- Employ strong derivatives governance and oversight

Balanced Portfolios Benefit as Well

Using a volatility-based risk mitigation strategy on the equity portion of a balanced portfolio is an effective way to adjust the equity/bond mix to changing risk environments, without the costs and timing issues of selling the underlying assets.

Positive Full Market Cycle Cost/Benefit

When a volatility-based portfolio risk management approach is maintained throughout a full market cycle, its outperformance in down markets can offset its underperformance in up markets, rendering a market-like return over a full cycle.

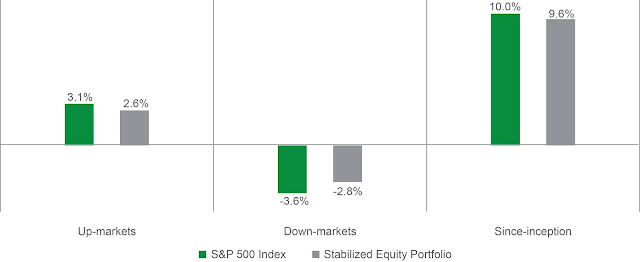

Chart 5: Thoughtful Equity Stabilization Can Pay for Itself Over a Full Market Cycle

Average Monthly Returns of the S&P 500 Index and the Stabilized Equity Portfolio Hypothetical Example in Up Markets, Down Markets, and Longer-term

Implementing a volatility-based risk mitigation approach by means of a derivative overlay means there is no disposition of underlying assets, merely a modification of risk exposures, thus avoiding trading costs and buy/sell spread costs. While there may be periodic ‘carrying costs’ of foregone performance in a bull market, the strategy tends to pay for itself over a full market cycle – avoiding the extensive long-term portfolio damage that a liquidity crisis during a bear market can wreak – as shown in Chart 5, above.

Portfolio Hedging is Vital after a Market Selloff

Perhaps counterintuitively, a volatility-based stabilization strategy is vital after a severe market shock, such as the recent COVID-19 pandemic shock.

After an historic downturn in the markets, most institutional portfolios are significantly underweight equities. In order to benefit fully when the markets inevitably recover – and in order to rebalance to their strategic asset mix targets – institutions need to re-risk by adding to their equity exposures.

This may be a difficult decision for many institutions, because the market bottom is only known to have occurred well after the fact. A reliable risk management strategy, such as the kind of volatility-based approach described in this paper, enables institutions to re-risk without needing to have certainty about the market bottom, as it entails significant protection against further drawdowns and yet will participate when the market recovers.

Summary: A Permanent Allocation to Volatility-Based Risk Mitigation is a Strategic Necessity for Institutional Investors

An airbag must be permanently installed in a car in order for it to deploy when it is needed – during the moment of impact, the timing of which cannot be predicted.

Similarly, we believe institutional investors obtain the best results from a stabilization approach based on volatility when they make it a full-time strategic allocation in their portfolios. A permanent strategic allocation to volatility-based stabilization ensures investors and their beneficiaries can benefit from the consistent and sustained mitigation of volatility shocks on an ongoing basis.

Securian Asset Management is an Associate Member of TEXPERS. The views expressed in this article are those of the authors and not necessarily Securian Asset Management nor TEXPERS.

About the Authors

Craig Stapleton, CFA, FRM is Senior Vice President – Head of ALM & Quantitative Strategies at Securian Asset Management. As Vice President and Portfolio Manager, Stapleton is responsible for derivatives, agency MBS, government and municipal bonds, quantitative analytics, cash management, ALM and strategic asset allocation for the Minnesota Life General Account. He is the head of the quantitative analysis and research group. Stapleton is also the co-portfolio manager for the Equity Stabilization strategies and the Securian Asset Management Strategic Dividend Income portfolios. Prior to his role as portfolio manager, Stapleton provided quantitative analysis, security and portfolio risk statistics, and derivatives hedging capabilities for Securian Asset Management and its clients. Stapleton is a CFA Charterholder, and a member of the CFA Institute and CFA Society of Minnesota.

Jeremy Gogos, Ph.D., CFA, is Vice President and Portfolio Manager of Quantitative Strategies at Securian Asset Management. He monitors domestic and international equity volatility and correlation, manages fund equity exposure, and evaluates equity allocation model performance. Gogos provides quantitative analysis, security and portfolio risk statistics, and execution of derivative and hedging initiatives. He has also supported annuity, life insurance, and investment product designs with stochastic and historical simulation and performance evaluation. Prior to joining Securian Asset Management, Gogos was a computer programmer supporting Securian Retirement’s 401(k) recordkeeping and trading platforms. He is a CFA Charterholder, and is a member of the CFA Institute and CFA Society of Minnesota.

No comments:

Post a Comment