Thursday, March 11, 2021

Tuesday, November 3, 2020

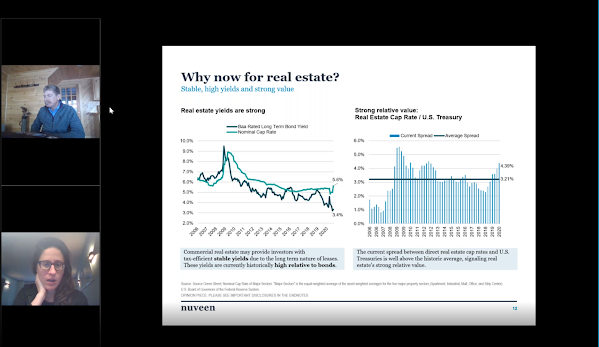

Catch Replay of Real Estate Investment Webinar

Pension Fund Trustees and Administrators Earn Continuing Education Credit Through TEXPERS' Online Learning

Friday, October 2, 2020

Committee Suggests Changes to 2019 Reporting Law

Recommendations Aim to Strengthen Law Requiring Independent Evaluations of Pension System Investments

Thursday, October 1, 2020

Wednesday, September 23, 2020

HPS Hosts Educational Webinar on Direct Lending

Wednesday, September 9, 2020

Janus Henderson Presents Educational Webinar

The Session is Part of a New Series of Online Learning Aimed at

Pension Fund Trustees and Admins

| Screen capture of Sept. 9, 2020, webinar hosted by TEXPERS and presented by Janus Henderson Investors. |

TEXPERS STAFF REPORT

The Texas Association of Public Employee Retirement Systems and hosted an online discussion on the often overlooked risk and return benefits of adding Real Estate Investment Trusts (REITs) to a broader real estate portfolio.

The educational webinar was present by Janus Henderson Investors on Wednesday, Sept. 9.

> ON DEMAND: Click to watch a recording.

Danny Greenberger, portfolio manager of Global Property Equities, and Guy Barnard, co-head and portfolio manager of Global Property Equities, at Janus Henderson lead the educational session.

Over the last decade, institutional investors have turned to a range of private investments – equity, debt and real estate – in search of higher returns, said Geenberger and Barnard. However, they added, that while private equities and debt have outperformed their listed counterparts for the past 20 years, the same cannot be said in real estate. According to their presentation, many public plans are significantly underweight Real Estate Investment Trusts (REITs) relative to the size of the asset class.

- The ability to access "non-core" property types – such as self-storage, cell towers, data centers, single tenant net lease and manufactured housing – with long-term cash flow growth opportunities;

- The ability to be more nimble when shorter-term market opportunities arise;

- Daily liquidity

Webinar | Taking Stock of Your Advisory Relationship: Outsource CIO, Consultants, and the Market

Presented by PFM LLC, PNC Capital Advisors, & CBIZ Inc.

10 a.m. CST on Tuesday, Sept. 15, 2020

Qualifies for 1 credit hour for Basic or Advanced Trustee Training in Investments.

Webinar | Direct Lending - The Benefits of Scale and Differentiated Sourcing

Presented by HPS Investment Partners

10 a.m. CST on Wednesday, Sept. 23, 2020

Qualifies for 1 credit hour for Basic or Advanced Trustee Training in Investments.

Mandated Training Hours

Texas law requires the Pension Review Board to establish a Minimum Educational Training Program for trustees and system administrators of state and local public retirement systems. The PRB's Minimum Educational Training requirements include core and non-core topic areas. New trustees and administrators must earn a minimum of 7 hours of training within their first year of service. Continuing trustees and administrators must receive a minimum of 4 hours of training every two years after their first year of service.

TEXPERS is offering credit training hours for core and non-core topics. New trustees and administrators needing additional first-year training may do so online through the PRB's website.

>ADDITIONAL TRAINING: Pension Review Board MET Info

In May, TEXPERS hosted Controlled Acceleration: Using Derivatives to Manage Pension Plan Risk, Return & Liquidity. Sponsored by TEXPERS Consultant Member River and Mercantile, the webinar is accessible through the association's blog.

>WEBINAR REPLAY: Controlled Acceleration

In July, TEXPERS hosted COVID-19: Impact on a Pension Plan's Liquidity. Also sponsored by TEXPERS Consultant Member River and Mercantile, a replay of the webinar is accessible through the association's blog.

>WEBINAR REPLAY: Impact of COVID-19 on Liquidity

Tuesday, September 8, 2020

PRB Investment Committee Meets Online Sept. 29

The Pension Review Board Investment Committee meeting will be

streamed online on its YouTube channel

|

| Image by Alexandra_Koch from Pixabay |

The Texas Pension Review Board will host its Investment Committee meeting by teleconference at 10 a.m. CST on Tuesday, Sept. 29, 2020.

Click here for the meeting agenda.

The committee meeting will be streamed online on the PRB’s YouTube channel. That link will be available on the PRB homepage, www.prb.texas.gov, before the session begins.

The PRB encourages anyone who wants to provide public comment to pre-register with the PRB’s Office Manager, Lindsay Seymour, by Sept. 29, 2020, at 8 a.m. CT. To pre-register, call 512-463-1736 or 800-213-9425. Or, send an email to prb@prb.texas.gov.

Friday, August 28, 2020

Pension Review Board Seeks Comments on 10-point Objectives Regarding Funding Policy and FSRP Requirements

|

| Image by Gerd Altmann from Pixabay |

By ALLEN JONES/TEXPERS Communications Manager

The Texas Pension Review Board is seeking feedback regarding changes it developed concerning legislative funding policy and funding soundness restoration plan statutes.

The Pension Review Board is a state agency charged with overseeing all state and local government public retirement systems in Texas concerning their actuarial soundness. The PRB's Actuarial Committee has outlined 10 objectives regarding the statues and is looking for comments from public pension systems and other interested parties.

>LEARN MORE: Read Our Past Coverage

In an Aug. 28 email from the PRB, the agency linked to a document of its proposed changes but pointed out that the reforms "are not fully developed."

"At this time, the PRB would appreciate comments, creative thoughts, and feedback on what is included in the document, or other ideas on how to accomplish the outlined objectives," according to the state agency's email, a copy of which is posted to the PRB's website.

The deadline to present public comments is Monday, Sept. 14. Email comments to prb@prb.texas.gov. The PRB's email states that agency staff is also available for discussion by phone. The PRB toll-free phone number is 800-213-9425.

PRB staff intends to submit comments to the Actuarial Committee during its scheduled meeting on Sept. 29, when the committee will determine which potential changes to the legislative statutes it will recommend to the agency's full Board of directors during a meeting on Nov. 12. The Board will then decide on the final legislative recommendations to present to the state Legislature.

To download the document, click here.

Below are the outlined changes presented in the document (click images to enlarge):

About the Author

Wednesday, August 26, 2020

Don't forget: House committee accepting reports on the impacts COVID-19 had on Texas pension funds

|

| Photo illustration/Canva.com. |

UPDATED Aug. 26, 2020 - There are just a couple of days left to let the Texas House of Representatives' Pension, Investment and Financial Services Committee know how the COVID-19 pandemic has impacted public pension systems.

Public pension systems have until 5 p.m. CT on Friday, Aug. 28, to provide written responses. Plan administrators who choose to file reports for their pension systems, email them to jason.briggs@house.texas.gov.

A previous email TEXPERS sent to its membership had a subject line indicating reports should be sent to the Pension Review Board. The email's subject line was incorrect. Reports should be sent to the House committee contact listed above. The information provided in the blog post linked to in the email was correct - reports should be filed with the House committee.

The Texas Legislative committee that writes law for public pension funds in the state on Aug. 4 requested regulated entities within its jurisdiction to submit written reports about the effects of COVID-19 on their operations and industry. The committee also asked whether pension funds experienced any statutory and regulatory barriers to responding to COVID-19.

> NOTICE: Access the formal committee request.

TEXPERS is encouraging its pension system members to submit reports for this House committee inquiry. The Legislature will consider the accounts as it drafts new laws in 2021. TEXPERS doesn’t know what those laws and responses will be, but the association does know that other quasi-governmental agencies will be submitting reports. In government, the squeaky wheel gets the grease, and it’s important for the Legislature to have a complete picture of the adjustments that our pension system members have made in 2020.

Plan administrators who choose to file reports for their pension systems, please email them to jason.briggs@house.texas.gov. Again, the due date is 5 p.m. Friday, Aug. 28. TEXPERS would appreciate a courtesy copy as well.

TEXPERS recommends that its member systems also create and file their reports or submit fund experiences to TEXPERS for the association to include in a report it plans to file. Those plans wishing to add their system reports in the association’s response should email them to media@texpers.org no later than Wednesday, Aug. 26.

The reports do not need to be extremely lengthy. TEXPERS offers the following chart as a guide to developing system responses. It is not exhaustive, so administrators who feel there are other ways that COVID-19 impacted their system or members should not hesitate to include them in their reports. Also, these subjects are just suggestions, and system administrators are under no obligation to respond to anyone of them.

|

|

Questions |

Responses |

|

Basic information |

|

|

|

Board and Committee

Meetings |

|

|

|

Compliance with State

Regulations |

State laws Senate Bill 2224 and House Bill 322 went into effect in 2020. The Funding policy for SB 2224 was due Jan. 1 and the independent assessment for HB 322 was due on May 1.

|

|

|

Member Services |

Many pension systems closed

their offices to member visits and asked members to work with benefits staff

by telephone, email or video conference meetings. Please address these

questions for active and retired members:

|

|

|

Office Operations |

|

|

|

Technology |

|

|

|

Investments |

|

|

Wednesday, August 5, 2020

PRB Actuarial Committee discusses Funding Soundness Restoration Plans

- Update on second FSRP from the City of Orange and Orange Firemen's Relief and Retirement Fund.

- Update on revised FSRP from City of Midland and Midland Firemen's Relief and Retirement Fund.

- A discussion of funding policies received by Government Code Section 802.2011 (Senate Bill 2224), including actuarially determined contribution benchmarks based on rolling amortization periods.

- A review of funding policy requirement under Section 802.2011 and FSRP requirements under Sections 802.2015 and 802.2016 of the Government Code.

> PRB MEETINGS: Find future meeting dates and past agenda packets.