Tuesday, November 3, 2020

Wednesday, September 30, 2020

Wednesday, September 23, 2020

HPS Hosts Educational Webinar on Direct Lending

Tuesday, September 15, 2020

TEXPERS Hosts Educational Webinar

Pension Industry Thought Leaders Discuss Outsourced CIO Relationships During Online Moderated Event

|

| Image by Alexandra_Koch from Pixabay |

What are the general duties of pension plan consultants and outsourced chief investment officers? TEXPERS gathered industry thought leaders for an educational webinar to give the trustees and administrators of TEXPERS' Member Systems advice on what pension plans should do to take stock of their funds' advisory relationships.

During the webinar, held Sept. 15, a moderator used a question-and-answer format allowing the panelists to identify some of the differences between non-discretionary and discretionary advisory models.

Click here to view a recording of the webinar. Those wanting to watch the video will be required to register for access.

During the session, the panel:

- Outlined some decision point considerations for plan trustees.

- Illustrated some of the more nuanced differences between the services.

- Revealed what the economic and market upheaval brought by the novel coronavirus pandemic has taught.

- Took audience questions relating to advisory relationships and the markets in general.

Future Webinars

TEXPERS is hosting educational webinars to help in the professional development of its Member Systems' trustees and administrators. Additional webinars are being planned.

The next webinar, Direct Lending – The Benefits of Scale and Differentiated Sourcing, will be held at 10 a.m. CDT on Wednesday, Sept. 23, 2020.

Synopsis: Since the Global Financial Crisis, investors globally continue in their search for yield, shifting capital from public to private markets, with private debt emerging as an attractive asset class for institutional investors seeking an illiquidity yield premium.

With the private debt market currently estimated to be ~$850 billion and likely to grow, in this webinar, Michael Patterson, Governing Partner and Portfolio Manager of Direct Lending Strategies at HPS Partners, will share insights on how best to extract attractive risk-adjusted returns through differentiated sourcing capabilities.Topics will include:

- Non-sponsor lending: not just sourcing, it’s about execution.

- Utilizing scale as a competitive advantage.

- Opportunities to find excess returns persist at the larger end of the lending market.

Earn Continuing Education Credits

New and Continuing pension system trustees and administrators who attended live webinars can earn one credit hour to satisfy state-mandated Continuing Education. To earn the credit, attendees are required to sit through the entire presentation, participate in polling questions during the session, and answer a survey emailed to attendees after the webinar. Those who do not sit through the webinar are unable to earn credit.

For additional information, email texpers@texpers.org or visit our website. Also, be sure to follow TEXPERS on Facebook and Twitter.

Thursday, August 13, 2020

TEXPERS building online learning series

|

| Image by Tumisu from Pixabay |

The outbreak of the novel coronavirus, the respiratory illness that causes COVID-19, has adversely impacted TEXPERS' ability to host its Annual Conference and Educational Forum this year. However, the association's staff is lining up online events offering members the ability to develop their professional skills and earn credit for their state-mandated training hours.

As an Accredited Sponsor of

the Pension Review Board of Texas, TEXPERS is providing credit hours of training to pension plan trustees and administrators. Several sessions formerly

to be held during the Annual Conference have been reconfigured for online

presentations that allow first-year and continuing trustees and administrators

to earn credit hours.

New and Continuing Trustees and Administrators may earn 1 credit hour per designated webinar. Each online session is lead by pension or investment industry experts.

Online sessions took

place in May and July, and three more are coming up in September. The

association staff is busy putting together additional educational programming

through November.

Upcoming Online Learning

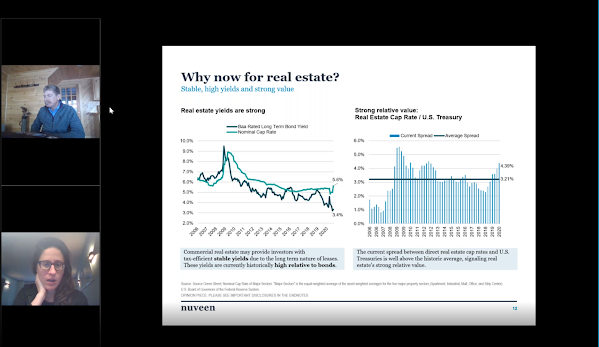

Webinar | Real Estate - Benefits of Combining Public and Private Allocations

Presented by Janus Henderson Investors

10 a.m. CST on Wednesday, Sept. 9, 2020

Qualifies for 1 credit hour for Basic or Advanced Trustee Training in Investments.

Presented by PFM LLC, PNC Capital Advisors, & CBIZ Inc.

10 a.m. CST on Tuesday, Sept. 15, 2020

Qualifies for 1 credit hour for Basic or Advanced Trustee Training in Investments.

Webinar | (Topic to be Determined)

Presented by HPS Investment Partners

10 a.m. CST on Wednesday, Sept. 23, 2020

Qualifies for 1 credit hour for Basic or Advanced Trustee Training in Investments.

Active links above mean a webinar is open for registration. TEXPERS will email registration details for future webinars to system members as they become available. Also, the association's website, blog, and social media pages will be updated with links to sign up for each online session.

>ADDITIONAL TRAINING: Pension Review Board MET Info

In May, TEXPERS hosted Controlled Acceleration: Using Derivatives to Manage Pension Plan Risk, Return & Liquidity. Sponsored by TEXPERS Consultant Member River and Mercantile, the webinar is accessible through the association's blog.

>WEBINAR REPLAY: Controlled Acceleration

In July, TEXPERS hosted COVID-19: Impact on a Pension Plan's Liquidity. Also sponsored by TEXPERS Consultant Member River and Mercantile, a replay of the webinar is accessible through the association's blog.

>WEBINAR REPLAY: Impact of COVID-19 on Liquidity

Membership Matters

TEXPERS has spent three decades providing high-quality training for its members, expanding awareness of public pension issues, and advocating for the promised benefits of public employees. TEXPERS' staff and board members are proud to offer trustees and administrators new ways to build their pension knowledge, which make its members more valuable to their funds and stakeholders.

Not a member of TEXPERS? Any Texas public employee retirement system and employee group or association is eligible for a TEXPERS membership immediately. Consultants, actuaries and vendors also are welcome to join at any time, however those applications will require approvals. For TEXPERS' Associate Memberships, there are a limited number of openings available. Once an application has been approved and an opening has become available, a TEXPERS staff member will follow up.

> JOIN TEXPERS: Membership information

About the Author: