Monday, December 21, 2020

Thursday, December 17, 2020

Wednesday, December 16, 2020

Tuesday, December 15, 2020

Cybersecurity

Recent massive infiltration of government, Fortune 500 company networks is reminder that hackers are a real threat

Wednesday, December 9, 2020

Tuesday, December 8, 2020

Committee Studies how Government Entities Pay for Lobbying

Interim committee takes testimony regarding governmental bodies that use public funds to pay for lobbying services

Friday, December 4, 2020

Thursday, December 3, 2020

Wednesday, December 2, 2020

Tuesday, December 1, 2020

Tuesday, November 10, 2020

PineBridge Investments Host Educational Webinar

Pension Fund Trustees and Administrators Earn Continuing Education Credit Through TEXPERS' Online Learning

Wednesday, November 4, 2020

Tuesday, November 3, 2020

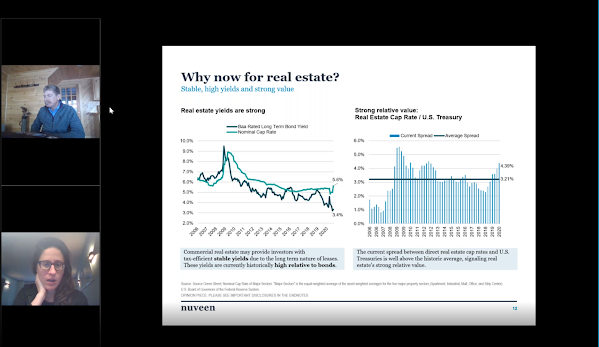

Catch Replay of Real Estate Investment Webinar

Pension Fund Trustees and Administrators Earn Continuing Education Credit Through TEXPERS' Online Learning

Thursday, October 29, 2020

Do Investors Care Who Wins the Election?

Whomever Wins the Presidency, Pressing Issues are Likely to Impact Performance of US Capital Market Indices

Investment Indices: The Inside Story

Both the Dow Jones Industrial Average and the S&P 500 Index Have Recently Made Changes. What Does That Mean for Retirement Investors?

Wednesday, October 28, 2020

Shelter in Place

What Are People Doing at Home? Watching Netflix, Riding Peloton, Eating Beyond Meat Burgers and ... Trading Stocks!

Tuesday, October 13, 2020

Friday, October 2, 2020

Committee Suggests Changes to 2019 Reporting Law

Recommendations Aim to Strengthen Law Requiring Independent Evaluations of Pension System Investments

Thursday, October 1, 2020

Wednesday, September 30, 2020

Wednesday, September 23, 2020

HPS Hosts Educational Webinar on Direct Lending

Tuesday, September 15, 2020

How Pension Funds Cope with Work-From-Home Environment

Survey Allows Pension System Administrators to Gauge Remote Work Policies of Industry Cohorts

Public Employees Go Above and Beyond Duty

Here are a Few Ways Public Employees Go the Extra Mile to Aid Communities

TEXPERS Hosts Educational Webinar

Pension Industry Thought Leaders Discuss Outsourced CIO Relationships During Online Moderated Event

|

| Image by Alexandra_Koch from Pixabay |

What are the general duties of pension plan consultants and outsourced chief investment officers? TEXPERS gathered industry thought leaders for an educational webinar to give the trustees and administrators of TEXPERS' Member Systems advice on what pension plans should do to take stock of their funds' advisory relationships.

During the webinar, held Sept. 15, a moderator used a question-and-answer format allowing the panelists to identify some of the differences between non-discretionary and discretionary advisory models.

Click here to view a recording of the webinar. Those wanting to watch the video will be required to register for access.

During the session, the panel:

- Outlined some decision point considerations for plan trustees.

- Illustrated some of the more nuanced differences between the services.

- Revealed what the economic and market upheaval brought by the novel coronavirus pandemic has taught.

- Took audience questions relating to advisory relationships and the markets in general.

Future Webinars

TEXPERS is hosting educational webinars to help in the professional development of its Member Systems' trustees and administrators. Additional webinars are being planned.

The next webinar, Direct Lending – The Benefits of Scale and Differentiated Sourcing, will be held at 10 a.m. CDT on Wednesday, Sept. 23, 2020.

Synopsis: Since the Global Financial Crisis, investors globally continue in their search for yield, shifting capital from public to private markets, with private debt emerging as an attractive asset class for institutional investors seeking an illiquidity yield premium.

With the private debt market currently estimated to be ~$850 billion and likely to grow, in this webinar, Michael Patterson, Governing Partner and Portfolio Manager of Direct Lending Strategies at HPS Partners, will share insights on how best to extract attractive risk-adjusted returns through differentiated sourcing capabilities.Topics will include:

- Non-sponsor lending: not just sourcing, it’s about execution.

- Utilizing scale as a competitive advantage.

- Opportunities to find excess returns persist at the larger end of the lending market.

Earn Continuing Education Credits

New and Continuing pension system trustees and administrators who attended live webinars can earn one credit hour to satisfy state-mandated Continuing Education. To earn the credit, attendees are required to sit through the entire presentation, participate in polling questions during the session, and answer a survey emailed to attendees after the webinar. Those who do not sit through the webinar are unable to earn credit.

For additional information, email texpers@texpers.org or visit our website. Also, be sure to follow TEXPERS on Facebook and Twitter.

Wednesday, September 9, 2020

Janus Henderson Presents Educational Webinar

The Session is Part of a New Series of Online Learning Aimed at

Pension Fund Trustees and Admins

| Screen capture of Sept. 9, 2020, webinar hosted by TEXPERS and presented by Janus Henderson Investors. |

TEXPERS STAFF REPORT

The Texas Association of Public Employee Retirement Systems and hosted an online discussion on the often overlooked risk and return benefits of adding Real Estate Investment Trusts (REITs) to a broader real estate portfolio.

The educational webinar was present by Janus Henderson Investors on Wednesday, Sept. 9.

> ON DEMAND: Click to watch a recording.

Danny Greenberger, portfolio manager of Global Property Equities, and Guy Barnard, co-head and portfolio manager of Global Property Equities, at Janus Henderson lead the educational session.

Over the last decade, institutional investors have turned to a range of private investments – equity, debt and real estate – in search of higher returns, said Geenberger and Barnard. However, they added, that while private equities and debt have outperformed their listed counterparts for the past 20 years, the same cannot be said in real estate. According to their presentation, many public plans are significantly underweight Real Estate Investment Trusts (REITs) relative to the size of the asset class.

- The ability to access "non-core" property types – such as self-storage, cell towers, data centers, single tenant net lease and manufactured housing – with long-term cash flow growth opportunities;

- The ability to be more nimble when shorter-term market opportunities arise;

- Daily liquidity

Webinar | Taking Stock of Your Advisory Relationship: Outsource CIO, Consultants, and the Market

Presented by PFM LLC, PNC Capital Advisors, & CBIZ Inc.

10 a.m. CST on Tuesday, Sept. 15, 2020

Qualifies for 1 credit hour for Basic or Advanced Trustee Training in Investments.

Webinar | Direct Lending - The Benefits of Scale and Differentiated Sourcing

Presented by HPS Investment Partners

10 a.m. CST on Wednesday, Sept. 23, 2020

Qualifies for 1 credit hour for Basic or Advanced Trustee Training in Investments.

Mandated Training Hours

Texas law requires the Pension Review Board to establish a Minimum Educational Training Program for trustees and system administrators of state and local public retirement systems. The PRB's Minimum Educational Training requirements include core and non-core topic areas. New trustees and administrators must earn a minimum of 7 hours of training within their first year of service. Continuing trustees and administrators must receive a minimum of 4 hours of training every two years after their first year of service.

TEXPERS is offering credit training hours for core and non-core topics. New trustees and administrators needing additional first-year training may do so online through the PRB's website.

>ADDITIONAL TRAINING: Pension Review Board MET Info

In May, TEXPERS hosted Controlled Acceleration: Using Derivatives to Manage Pension Plan Risk, Return & Liquidity. Sponsored by TEXPERS Consultant Member River and Mercantile, the webinar is accessible through the association's blog.

>WEBINAR REPLAY: Controlled Acceleration

In July, TEXPERS hosted COVID-19: Impact on a Pension Plan's Liquidity. Also sponsored by TEXPERS Consultant Member River and Mercantile, a replay of the webinar is accessible through the association's blog.

>WEBINAR REPLAY: Impact of COVID-19 on Liquidity

Tuesday, September 8, 2020

PRB Investment Committee Meets Online Sept. 29

The Pension Review Board Investment Committee meeting will be

streamed online on its YouTube channel

|

| Image by Alexandra_Koch from Pixabay |

The Texas Pension Review Board will host its Investment Committee meeting by teleconference at 10 a.m. CST on Tuesday, Sept. 29, 2020.

Click here for the meeting agenda.

The committee meeting will be streamed online on the PRB’s YouTube channel. That link will be available on the PRB homepage, www.prb.texas.gov, before the session begins.

The PRB encourages anyone who wants to provide public comment to pre-register with the PRB’s Office Manager, Lindsay Seymour, by Sept. 29, 2020, at 8 a.m. CT. To pre-register, call 512-463-1736 or 800-213-9425. Or, send an email to prb@prb.texas.gov.

Monday, August 31, 2020

TEXPERS Launches Redesigned Website

Members Can Now Track

Continuing Education Credits Earned Online

The Texas Association of Public Employee Retirement Systems (TEXPERS) recently launched its redesigned website. The website, www.texpers.org, offers a user-friendly browsing experience for the association’s members, prospective members, and business partners.

“The new design offers streamlined menus, clear navigation, and a responsive layout for multiple platforms such as desktops, tablets, and mobile phones,” said Art Alfaro, TEXPER’s executive director. “The association staff are excited to have this project completed.”

Features and benefits of the newly designed site include:

- A more connected membership with social networking support

- Simple tools for membership to stay in touch

- Space for members to share resources and information

- Ability for members to keep records of their Continuing Education credit hours online

- Serving as primary source to collect membership dues and support event registrations

TEXPERS members who want to track their Continuing Education training credit hours will need to log into the site. Once logged in, visitors will see a "welcome" notice on the page along with the user's name. Once the visitor has accessed their member site, users can click on the "Your CE Credits" tab in the Quick Links panel on the right of the site page.

Once logged in, TEXPERS members may also update their profile or organization information, access a directory of members, and find links to the association's bylaws. The the site provides a news feed of the association's blog as well as live updates of TEXPERS' Twitter feed. Also, members should frequent the site to stay up to date on the association's latest events.

Now Live

The newly designed TEXPERS website is now live at www.texpers.org. The site is hosted through MemberClicks, which provides software solutions to help member-based organizations such as TEXPERS with membership management, event registration, and database needs.

The Texas Association of Public Employee Retirement Systems is a statewide, voluntary nonprofit educational association organized in 1989. Operated out of Austin, Texas, its members are trustees, administrators, professional service providers, employee groups and associations engaged or interested in the management of public employee retirement systems. TEXPERS member systems and employee group members represent 2.3 million active and retired public employees with assets totaling nearly $89 billion.

Friday, August 28, 2020

Pension Review Board Seeks Comments on 10-point Objectives Regarding Funding Policy and FSRP Requirements

|

| Image by Gerd Altmann from Pixabay |

By ALLEN JONES/TEXPERS Communications Manager

The Texas Pension Review Board is seeking feedback regarding changes it developed concerning legislative funding policy and funding soundness restoration plan statutes.

The Pension Review Board is a state agency charged with overseeing all state and local government public retirement systems in Texas concerning their actuarial soundness. The PRB's Actuarial Committee has outlined 10 objectives regarding the statues and is looking for comments from public pension systems and other interested parties.

>LEARN MORE: Read Our Past Coverage

In an Aug. 28 email from the PRB, the agency linked to a document of its proposed changes but pointed out that the reforms "are not fully developed."

"At this time, the PRB would appreciate comments, creative thoughts, and feedback on what is included in the document, or other ideas on how to accomplish the outlined objectives," according to the state agency's email, a copy of which is posted to the PRB's website.

The deadline to present public comments is Monday, Sept. 14. Email comments to prb@prb.texas.gov. The PRB's email states that agency staff is also available for discussion by phone. The PRB toll-free phone number is 800-213-9425.

PRB staff intends to submit comments to the Actuarial Committee during its scheduled meeting on Sept. 29, when the committee will determine which potential changes to the legislative statutes it will recommend to the agency's full Board of directors during a meeting on Nov. 12. The Board will then decide on the final legislative recommendations to present to the state Legislature.

To download the document, click here.

Below are the outlined changes presented in the document (click images to enlarge):

About the Author